The Bottom Line Up Front: Moving to or touring the United States is a scale exercise. While the cost of living in USA continues to climb—driven by a steady index rise since 2011—the reality on the ground varies wildly. You might pay $4,000 for a studio in Manhattan or $900 for a three-bedroom house in rural Kansas.

Success requires more than a visa; it demands a granular understanding of state taxes, healthcare premiums, and the specific “hidden” costs of American consumerism. If you are chasing the American Dream, bring a spreadsheet and a healthy sense of pragmatism.

Don’t Forget To Check: Cost of Living in Washington State: A Monthly Guide

The Reality of the American Price Tag

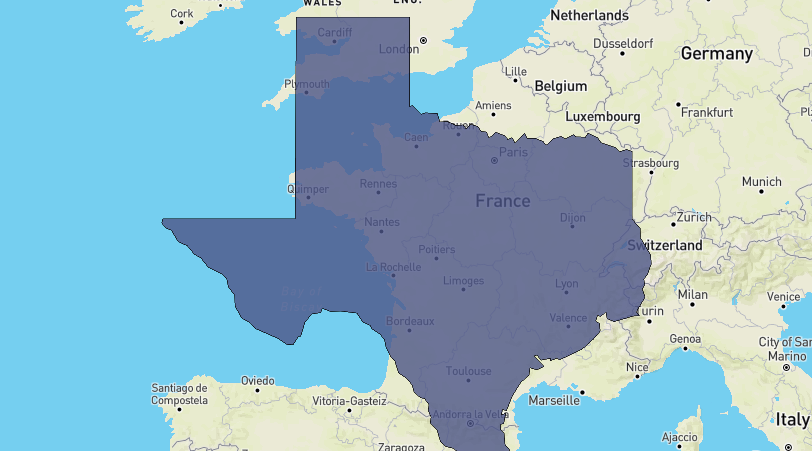

The United States is not just a country; it is a continent-sized economic engine. When people discuss the cost of life usa, they often overlook the “transportation tax.” Unlike the compact cities of Europe where a ferry crossing or a train ride connects you to everything, the U.S. is built for the car. I remember my first month in Houston; I tried to walk to a grocery store that looked “close” on the map. Forty minutes later, sweating under a relentless Texas sun and trapped by a twelve-lane highway with no sidewalk, I realized that the living cost in usa is inextricably linked to fuel and four wheels.

According to recent data from the U.S. Commerce Department, the cost of living index united states has been on a vertical trajectory. This isn’t a local quirk. As Ethan Harris of Bank of America Merrill Lynch noted, this is a global shift, but America feels it differently because of its high consumption rates.

Breaking Down the Cost of Living Index in the USA

The index measures income and consumption against expenditures. If you’re dwelling in London or Paris, you’re used to high prices. But the U.S. adds layers of complexity, specifically in “Service Inflation.”

| State / Region | Average Monthly Rent (1BR) | Estimated Monthly Groceries | Local Vibe |

| California (SF/LA) | $2,800 – $3,500 | $550 | High-tech, coastal, expensive |

| Texas (Austin/Dallas) | $1,500 – $2,100 | $400 | Boomtowns, no state income tax |

| Florida (Miami/Orlando) | $1,800 – $2,400 | $450 | Humidity, tourism-driven, no state tax |

| Midwest (Ohio/Indiana) | $900 – $1,300 | $350 | Affordable, slower pace, four seasons |

Expert Field Note: The Tipping Trap

In Europe, a tip is a gesture. In the USA, it is a mandatory supplement to a worker’s sub-minimum wage. Expect to add 18% to 25% to every restaurant bill, bar tab, and taxi ride. If you don’t factor this into your living costs usa budget, you’ll find your “affordable” dinner out is 20% more expensive than the menu suggested.

Navigating the American Job Market

Finding a job in the States isn’t fundamentally different from the UK or EU, but the intensity is higher. Networking isn’t just a suggestion; it is the primary currency of the labor market. Even if your personal network feels microscopic, start shouting into the void of LinkedIn.

The job market is split into massive sectors. The “Economic Sector”—services, both commercial and non-commercial—accounts for roughly 80% of the GDP. But the geography dictates the opportunity. If you are in food processing, you head to the Central Valley of California. If you are in hospitality, Florida is your playground.

The Tax Reality

When you finally land that paycheck, don’t expect to keep it all. The American federal government takes its cut, but then the state steps in. Some states, like Texas and Florida, have zero income tax. Others, like New York or California, will take a significant second bite. Then come the local municipal taxes. It’s a jigsaw puzzle of deductions that can leave your “gross salary” looking quite lean.

Starting a Business: Buying the Green Card

For those with deep pockets, the EB-5 visa remains the most direct route. An investment of $1,000,000 into a US business that employs at least ten people is essentially “buying a Green Card.” It sounds clinical, but the process is a marathon of due diligence.

But there’s a catch. The “consumer market” in America is fickle. While Americans are traditionally willing to spend on both essentials and luxuries, the fluctuating cost of living in usa has squeezed purchasing power. If you’re setting up a “Small and Medium-sized Enterprise” (SME)—defined in the U.S. as any business with fewer than 500 employees—you need a marketing plan that accounts for the specific regionalism of your chosen state.

Business Structures at a Glance

| Structure | Liability | Best For |

| Sole Proprietorship | Unlimited personal liability | Freelancers and consultants |

| Partnership | Shared personal liability | Small professional firms |

| Corporation (Inc.) | Limited liability | Large-scale growth and investment |

| LLC | Limited liability | Most small to medium businesses |

Studying in the States: The $35,000 Year

The American university experience is iconic—the “quad,” the sports culture, the specialized graduate programs. But the cost living in usa for a student is astronomical compared to most European institutions.

A single academic year (9 months) can set you back anywhere from $15,000 to $35,000. This includes “room and board,” books, and the mandatory insurance. I’ve seen international students stunned by the price of textbooks alone; it’s not uncommon to spend $800 a semester just for reading materials.

Pro-Tip: If you are a student, look into “Community Colleges.” They offer the first two years of a Bachelor’s degree at a fraction of the cost of a major university. You get the same credits, but you save enough to actually afford a weekend trip to New Orleans or Vegas.

The Housing Crisis: Renting vs. Buying

The popularity of rental properties is at an all-time high, largely because getting a mortgage in the States as a foreigner is like trying to find a quiet spot in Times Square—nearly impossible without a long-term credit history.

The Rental Market

If you’re not ready to buy, you’ll likely deal with a “Landlord.” In the U.S., the lease is king. Most contracts are for six months or a year. The landlord is responsible for the “guts” of the house—water, electricity, waste—but the tenant is responsible for the “vibe” and the upkeep.

Watch out: If you fall behind on rent by even a week or leave the property unattended without notice, American law is often heavily weighted in favor of the landlord. Eviction can happen faster than you think.

Buying the Dream

To buy, you need a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). American banks generally only lend to those with American jobs. If you’re buying a second home, expect higher interest rates and a massive down payment—often 30% or more for foreign nationals.

Expert Field Note: The “Hidden” Closing Costs

When you buy a house in the USA, the sticker price is just the beginning. Between inspections, lawyer fees, and “title insurance,” you should set aside an extra 3% to 5% of the purchase price. I once saw a buyer lose their earnest money because they forgot to budget for the specific “mansion tax” in certain New York zip codes.

Touring the Continent: RVs, Cars, and Bikes

If you aren’t moving, you’re likely touring. The scale of the U.S. is best experienced on the road. Route 66, the Niagara Falls, the Pacific Coast Highway—these aren’t just names; they are rites of passage.

The Motorhome (RV) Life

Renting an RV (motorhome) gives you a “rolling house.” An A-class RV can fit ten people, but driving one through the narrow streets of New England is a nightmare. It’s better for the wide-open West. The price varies based on “milage” (fuel is a massive expense) and where you drop it off.

The Road Trip Car

Renting a car is the most flexible way to see the country. You can cover more ground and actually park in a city. Gas is cheaper than in Europe, but the distances are longer. A “quick drive” from Los Angeles to Las Vegas is four hours of desert heat.

The Low-Budget Bike

Cycling across America is the ultimate adventure, but it’s not for the faint of heart. You’ll see the “real” America—the small-town diners where the coffee is bottomless and the pie is made by someone named Mabel—but you’ll also deal with massive trucks on narrow shoulders.

How to Calculate Your Moving Budget to the USA

-

Request Multiple Quotes: Don’t settle for the first international mover you find. Get at least five quotes. The “sea freight” vs. “air freight” price gap is enormous.

-

Verify State Taxes: Use an online calculator to see what your “take-home” pay will actually be in your destination state.

-

Audit Your Credit Score: If you can, get an American credit card while still abroad (some banks offer this) to start building a history. Without a “score,” your cost of life usa increases because you’ll have to pay larger deposits for utilities and rent.

-

Health Insurance Audit: Do not move without a plan. A single trip to the Emergency Room for a broken arm can cost $2,500 without insurance.

-

Calculate the “Car Tax”: Research the cost of car insurance and registration in your specific state. In places like Michigan, insurance is notoriously high.

The Cultural Landscape: Beyond the Movies

American culture is a paradox. It is highly individualistic yet deeply communal in its religious and local circles. It is a “land of opportunity,” but that opportunity comes with a lack of the social safety nets you find in Europe.

The cuisine is a perfect example of this “melting pot” (though I prefer the term “stew”). You have the fast-food chains that have conquered the world, but you also have the regional soul food of the South, the sourdough of San Francisco, and the spicy Tex-Mex of the borderlands.

Holidays and Retirement

Independence Day (July 4th) is the big one. Parades, fireworks, and the smell of charcoal grills. But “Labor Day” and “Thanksgiving” are arguably more important for family gatherings.

Retiring in the States is a different beast entirely. Emigrating affects your pension schemes. You generally need a permanent residence permit and a history of paying into the U.S. Social Security system to reap the benefits. Medicare kicks in at 65, but it doesn’t cover everything. You will still need “Medigap” insurance to stay afloat.

Comparison of Travel Modes in the USA

| Mode | Flexibility | Cost Level | Best For |

| RV Rental | High (Sleep anywhere) | High (Fuel + Rental) | National Parks / Families |

| Rental Car | High (City friendly) | Moderate | Couples / Road Trips |

| Internal Flights | Low (Airport to Airport) | Variable | Cross-country speed |

| Amtrak (Train) | Medium | Moderate | East Coast / Scenic routes |

Expert Field Note: The Salt Air and the Tolls

On my last trip across the Atlantic, I transitioned from the ferry docks of Europe to the highways of the East Coast. There’s a specific smell to the American coast—brine mixed with diesel. But the real “welcome” was the George Washington Bridge toll. In the States, “express lanes” and bridge tolls are increasingly digitized. If you don’t have an “E-ZPass” transponder in your rental car, you’ll be hit with administrative fees that turn a $15 toll into a $50 headache.

FAQ: Everything You Need to Know About the Cost of Living in USA

Is the cost of living in the USA higher than in Europe?

Generally, yes, especially regarding healthcare and education. While petrol and electronics are cheaper, the “safety net” costs (insurance, savings for retirement) are much higher.

What is the cheapest state to live in?

States like Mississippi, Arkansas, and West Virginia consistently have the lowest cost of living index in the United States, but they also typically have lower average salaries.

Can I buy a house in the USA as a non-resident?

Yes, but you will likely need to pay in cash or provide a very large down payment (30-50%) because you lack a US credit history.

How much should I budget for groceries in the US?

For a single person, expect to spend $400 – $600 per month depending on whether you shop at budget stores like Aldi or premium ones like Whole Foods.

What is a “good” salary for a family of four?

In a mid-sized city, a household income of $80,000 – $100,000 is generally considered comfortable, but in cities like San Francisco, $150,000 can still feel tight.

Is healthcare really that expensive?

Yes. Without employer-sponsored insurance, a private plan for a family can cost $1,500+ per month, and you still have to pay “deductibles.”

Are there hidden costs when renting?

Most apartments require “First, Last, and Security”—meaning you need three months of rent upfront before you even move in a single box.

Do I need a car in the USA?

Unless you are in NYC, Chicago, or Boston, yes. Public transport in most US cities is insufficient for daily life.

What is the average cost of a gallon of gas?

It fluctuates, but expect to pay between $3.00 and $5.00 depending on the state (California is always the most expensive).

How does the US tax system work for foreigners?

You are taxed on your US-sourced income. Depending on your visa, you may also be taxed on your worldwide income if you pass the “Substantial Presence Test.”

What is the best time to tour the USA?

Spring (April-May) and Autumn (September-October) offer the best weather and lower prices than the summer “high season.”

Are tips included in the bill?

Rarely. Some restaurants add a “Service Charge” for large groups (6+), but otherwise, you are expected to calculate and add the tip yourself.

Pingback: Average Cost of Living in Washington State: A Monthly Guide | SeaFranceHolidays

Pingback: Working in Canada as a US Citizen: The Definitive Guide to Permits and Jobs | SeaFranceHolidays