Washington State, the “Evergreen State,” offers a lifestyle that ranges from the high-tech, caffeine-fueled streets of Seattle to the quiet, sun-drenched apple orchards of Yakima. However, this diversity comes with a price tag that varies just as dramatically. If you are considering a move to the Pacific Northwest, understanding the average cost of living in Washington state per month is the first step in avoiding “sticker shock.”

Don’t Forget To Check: Cost of Living in USA : The Ultimate Relocation & Travel Guide

Average Cost of Living in Washington State: A Comprehensive Monthly Breakdown

On my last trip through the Puget Sound area, I stopped in Tacoma for lunch and was struck by how the local economy has shifted. While it used to be the “affordable” alternative to Seattle, the rising tide of the regional tech economy has pushed prices up across the board. Whether you are looking for a rain-soaked forest retreat or a chic metropolitan condo, here is what your bank account can expect.

The Big Picture: Average Cost of Living in Washington State

The average cost of living in Washington is notably higher than the national average, primarily driven by the red-hot housing market in the western corridor. However, the lack of a state income tax remains a significant draw for high earners, often offsetting the higher costs of groceries and utilities.

Monthly Expenditure Estimates

To live comfortably in Washington as a single person, you should anticipate a monthly cost of living in Washington state of approximately $3,800 to $4,500 in urban centers, or closer to $2,800 in rural eastern regions. For a family of four, that number can easily climb to $7,000 per month when childcare and larger housing are factored in.

| Expense Category | Monthly Estimate (Single) | Monthly Estimate (Family of 4) |

| Housing & Utilities | $1,800 – $2,600 | $3,200 – $4,800 |

| Groceries | $450 – $600 | $1,200 – $1,500 |

| Transportation | $350 – $500 | $800 – $1,200 |

| Healthcare | $300 – $450 | $1,000 – $1,400 |

Housing: The Gateway to the Evergreen State

Housing is, without question, the largest component of the average living cost in Washington state. The geography of the state creates a “price cliff” at the Cascade Mountains. West of the mountains (Seattle, Bellevue, Tacoma), you pay for proximity to the coast and tech hubs. East of the mountains (Spokane, Kennewick), your dollar stretches significantly further.

The Seattle vs. Spokane Divide

In Seattle, a one-bedroom apartment rarely dips below $2,200 in a safe, walkable neighborhood. Conversely, in Spokane, you can still find comparable units for $1,300 to $1,500. During a recent real estate scouting trip in Vancouver, WA, I noticed that while prices are rising, the city remains a popular “tax haven” for those who work in Portland, Oregon, but want to avoid Oregon’s high income tax.

Utility Costs and Climate Impact

Washington benefits from abundant hydroelectric power, which keeps electricity rates relatively competitive. However, the damp climate in the west requires consistent heating and dehumidifying during the long winter months, while the east demands heavy air conditioning during scorching summers. Expect to budget $150–$250 per month for basic utilities.

Pro-Tip: If you are moving to Western Washington, look for “ADUs” (Accessory Dwelling Units) or basement apartments in older neighborhoods like Ballard or Queen Anne. These often provide a significant discount compared to modern “luxury” apartment complexes and include utilities in the rent.

Comparison: Washington vs. Other Major States

Choosing between Washington and another state often comes down to the trade-off between salary potential and daily expenses.

| State | Median Home Price | State Income Tax | Cost of Living Index |

| Washington | $620,000 | 0% | 115.1 |

| California | $830,000 | 1% – 13.3% | 138.5 |

| Texas | $345,000 | 0% | 93.0 |

| Florida | $405,000 | 0% | 102.8 |

Washington vs. California

Washington is generally more affordable than California, particularly regarding housing and gas prices. The average cost of living in Washington state allows for a higher “disposable income” because you aren’t losing 10% of your paycheck to the state government.

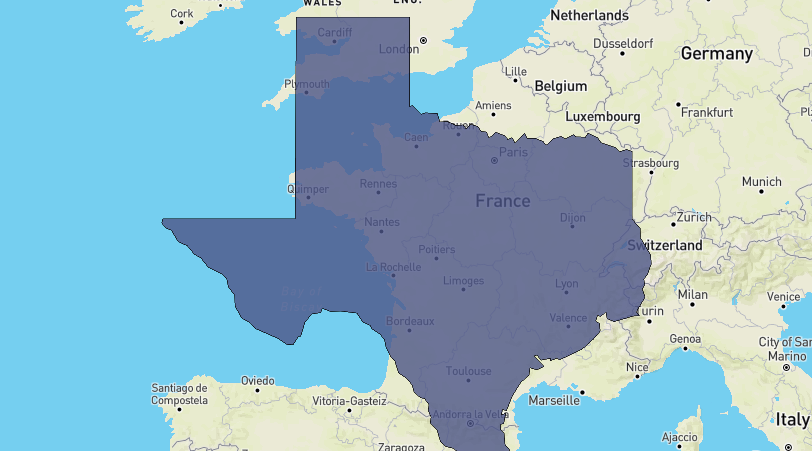

Washington vs. Texas

Texas is significantly cheaper in terms of real estate, but Washington offers higher median wages and a more robust social safety net. Many professionals find that the “Washington Premium” is worth paying for the temperate climate and access to world-class outdoor recreation.

Daily Life: Food, Transport, and Healthcare

Beyond the rent, the monthly cost of living in Washington state is influenced by the “hidden” costs of being in the northwest.

Grocery Expenses

While Washington is an agricultural powerhouse (think apples, cherries, and hops), grocery prices are roughly 5-10% above the national average. A gallon of milk averages $4.00, and a dozen eggs can vary between $3.50 and $5.00 depending on the season and “organic” preferences.

Transportation and the “Commute Tax”

Gasoline in Washington is among the most expensive in the nation due to state fuel taxes. If you live in King County, you will also face high vehicle registration fees (RTA tax) which fund the light rail system. If you can live near a Link Light Rail station, you can potentially ditch the car and save upwards of $600 a month.

Healthcare Quality and Costs

Healthcare in Washington is top-tier, featuring institutions like UW Medicine. However, premiums and out-of-pocket costs are higher than in the Southeast or Midwest. Budgeting at least $400 a month for a silver-level health plan is a realistic baseline for individuals.

Pro-Tip: Frequent the local farmer’s markets. Places like the Pike Place Market (the lower sections) or the Olympia Farmers Market offer incredible deals on bulk produce that actually beat the prices at big-box retailers like Safeway or QFC.

Expert Recommendations for Budgeting in WA

-

Leverage the “No Income Tax” Advantage: Maximize your 401k or IRA contributions. Since you aren’t paying state income tax, you have more liquidity to build your “house down payment” fund.

-

Move “One Town Over”: If you work in Bellevue, look at Bothell or Issaquah. The 20-minute increase in commute can save you $500 a month in rent.

-

Use Public Transit: Washington’s ORCA card system is seamless. If your employer offers a transit pass, take it. Parking in downtown Seattle can cost $300–$500 a month alone.

-

Affiliate Recommendation: When moving, use a service like HireAHelper or Moving.com to compare rates. Washington is a “difficult” state for movers due to the ferries and steep hills, so professional help is worth the investment. For temporary stays while house hunting, check Booking.com for extended-stay hotels in Tacoma or Lynnwood to save money.

How to Calculate Your Budget for a Move to Washington

-

Determine Your “Regional Target”: Decide if you are an “I-5 Corridor” (West) or “High Desert” (East) resident. Your housing budget will fluctuate by 40% based on this choice.

-

Estimate Your Tax Savings: Use an online calculator to see how much you save by moving from a state with income tax. Apply that “found money” to your housing budget.

-

Factor in the RTA Tax: If moving to King, Pierce, or Snohomish counties, check the car tabs estimator. It can cost $400+ a year for a modern vehicle.

-

Account for “Rain Gear” and Lifestyle: It sounds silly, but a high-quality Gore-Tex jacket and proper boots are mandatory equipment. Budget $500 for a “PNW Starter Kit.”

-

Secure Healthcare Quotes: Visit the WA Healthplanfinder website to see actual premiums based on your income before you commit to a salary offer.

Frequently Asked Questions (FAQ)

What is the average cost of living in Washington state per month for a single person?

A single person should expect to spend between $3,200 and $4,500 per month. This includes $2,000 for rent and utilities, $500 for food, and $400 for transportation and miscellaneous costs.

Is Washington state more expensive than Oregon?

Washington is generally slightly more expensive than Oregon in terms of housing and sales tax. However, Washington has no state income tax, whereas Oregon has one of the highest in the country, often making Washington more affordable for high-income earners.

What is a comfortable salary to live in Washington state?

For a single person in Seattle, a salary of $85,000 is considered “comfortable.” In Eastern Washington cities like Spokane, $55,000 to $60,000 provides a similar standard of living.

Why is the cost of living in Washington so high?

The primary drivers are the massive growth of the technology sector (Amazon, Microsoft), limited housing inventory in the Puget Sound area, and high state taxes on fuel and retail goods.

Is there a state income tax in Washington?

No. Washington is one of a handful of states with no personal state income tax. This is a major factor in the state’s high “median household income.”

How much do utilities cost in Washington state?

The average monthly utility bill (electricity, heat, water, trash) is approximately $175 to $250 for a standard apartment.

Are groceries expensive in Washington?

Yes, groceries in Washington are about 8-10% higher than the national average, though local seasonal produce can be found at lower prices in rural areas.

What is the sales tax in Washington?

The base state sales tax is 6.5%, but local jurisdictions can add to this. In Seattle, the total sales tax is 10.25%.

Is it cheaper to live in Eastern or Western Washington?

Eastern Washington is significantly cheaper. Housing, services, and even some food items are 20-30% less expensive in cities like Yakima, Spokane, and Tri-Cities compared to the Seattle metro area.

Does Washington have a high property tax?

Washington’s property taxes are around the national average (approx. 0.94%). However, because home values are high, the total dollar amount paid by homeowners can feel substantial.

Pingback: Cost of Living in USA 2026: The Ultimate Relocation & Travel Guide | SeaFranceHolidays