Are you planning to travel anywhere soon? As exciting as it may be, traveling comes with its fair share of risks. From flight cancellations to medical emergencies, unexpected incidents can quickly turn a dream vacation into a nightmare. That’s where travel insurance comes in. World2Cover is one such insurance provider that aims to protect you from these uncertainties and give you peace of mind while you explore new destinations. In this review, we’ll take a closer look at World2Cover, their policies, and whether they’re the right fit for your travel needs. So buckle up and let’s dive in!

Table of Contents

1. Mixed Reviews: Customers Share Experiences with World2Cover

When it comes to World2Cover, customers seem to have mixed experiences with the company. Some reviewers claim that their service was amazing, and they felt that other companies could learn from them. One person mentioned that they received a quick refund when they realized they didn’t need the policy. They also stated that if they lost their free travel insurance in the future, they would turn to World2Cover again. However, other customers were extremely dissatisfied. One person had to wait two months for their claim to be resolved after missing their flight, and they were only reimbursed a small amount. Another customer was shocked by how much extra they had to pay to add just one day to their existing policy, and they felt they were being taken advantage of. Finally, one customer claims that after their flight was cancelled, World2Cover never paid them anything and never responded to their emails despite seven months of trying.

As with any insurance company, it’s essential to read the fine print before committing to a policy, but it’s clear that World2Cover has both positive and negative reviews. Their customer service appears to be top-notch when things go smoothly, but issues can arise when it comes to making a claim. World2Cover is certainly a company worth considering, but it’s important to weigh the positives and negatives before making a decision.

In terms of their coverage, World2Cover offers a range of options, such as medical and emergency evacuation, dental expenses, and cancellation or amendment expenses. They also cover events such as hijacking, civil unrest, and pandemics like COVID-19, but coverage is assessed on individual circumstances. They have varying limits per person for different expenses, such as medical and emergency evacuation, dental expenses, and cancellation or amendment fees. Coverage for frequent flyer points and travel agent cancellation fees is also assessed on individual circumstances. Unfortunately, some customers have faced technicalities that have prevented them from being fully reimbursed for their expenses.

In conclusion, World2Cover is an insurance company with mixed reviews. They offer various coverages, and their customer service appears to be excellent when things go smoothly. However, customers have faced technicalities that have prevented them from being fully reimbursed for their expenses, and others have experienced difficulty with claim processing and communication. As with any insurance company, it’s essential to read the fine print and weigh the positives and negatives before signing up for a policy.

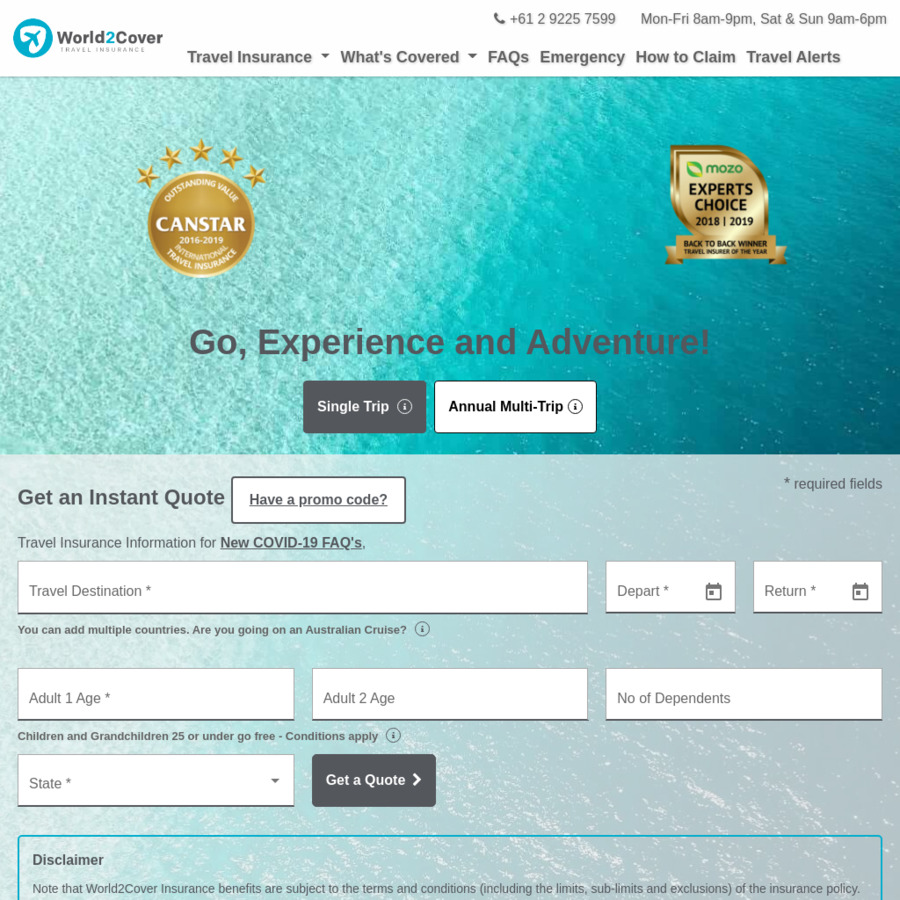

2. World2Cover Wins Multiple Travel Insurance Awards

World2Cover has won multiple travel insurance awards in 2019 and 2022. The company was named Travel Insurance Company of the Year 2023 by Tokio Marine & Nichido Fire Insurance Co Ltd. The travel insurance company offers coverage for overseas medical and hospital costs arising from illness or injury that occurs during the period of insurance. The coverage can be availed up to 12 months from the time the treatment is received. However, the coverage is subject to some conditions, sub-limits, and exclusions which need to be reviewed before purchasing any travel products from the company.

Based on reviews of the travel insurance company on ProductReview.com.au, some customers had a bad experience. One customer claimed that the company took two months to resolve a claim for accommodation connected with a missed flight. The customer was reimbursed little and various technicalities were cited. Meanwhile, another customer complained of the high cost of coverage, where one day extra cover added $147.43 to an existing 21-day policy. World2Cover was accused of using price points that take advantage of the consumers.

Despite the negative feedback, other customers had good experiences with World2Cover. One customer praised the company for being customer-focused when he requested to cancel a travel insurance policy after realizing that he had free insurance as part of his union membership. Another customer commended the company for its excellent service, honesty, and helpfulness. The customer was admitted to the hospital overseas and underwent unexpected medical surgery and hospitalization. World2Cover paid all the expenses upon the customer’s return to Australia within the agreed ten days of making the claim.

Overall, World2Cover has won multiple awards for its travel insurance services. However, customer reviews show that there have been some issues that need to be addressed. The terms and conditions, sub-limits, and exclusions must be reviewed before purchasing travel products from the company. Despite some negative feedback, World2Cover has also received positive reviews from customers who were pleased with the company’s customer-focused approach and excellent service.

3. Issuer of World2Cover Travel Insurance: Tokio Marine & Nichido Fire Insurance Co Ltd

World2Cover Travel Insurance is issued by Tokio Marine & Nichido Fire Insurance Co Ltd, and has received multiple awards, including Travel Insurance Company of the Year in 2019 and 2022. Their customer service hours cater to their clients’ needs beyond typical business hours, and their website provides transparent information on policies and terms. However, the reviews from Australian customers on ProductReview.com.au indicate mixed experiences with the company.

One customer experienced an extended and unsatisfactory claims process that only resulted in a small reimbursement. In contrast, another customer appreciated World2Cover’s swift customer service when they needed to cancel their policy. The former customer reported a faulty pricing system that charges individuals for extra days of coverage that are not needed or requested. As for the latter customer, they stated that World2Cover provided excellent service during a medical emergency that required hospitalization overseas and an unexpected flight back home.

In response to negative customer reviews, World2Cover’s representative from Tokio Marine offered assistance to review the customers’ cases and resolve any outstanding issues. They suggested that customers reach out to their customer service via email or phone. However, some customers reported difficulty in reaching them through the provided email addresses.

Before purchasing travel insurance, potential customers are advised to review the Product Disclosure Statement and Target Market Determinations carefully, as they differ between policies. Despite mixed reviews, World2Cover’s unlimited coverage for overseas medical and hospital expenses for up to 12 months makes them an option worth considering for those who prioritize comprehensive coverage. [**]

4. General Advice for Purchasing Travel Products

When it comes to purchasing travel insurance, it’s important to do your research and choose a provider that will offer you the coverage you need. World2Cover is one such provider, and reviews from customers on ProductReview.com.au are mixed. Some have had positive experiences, citing excellent customer service and quick refunds for cancelled policies. Others, however, have experienced frustrating delays and poor communication when making claims.

One customer reported taking out a policy for a trip to Europe and the Maldives, only to find out they had free travel insurance through their union membership. They contacted World2Cover to cancel the policy and were pleasantly surprised by the quick response and refund of their premium. Another, however, found adding just one extra day of coverage to be exorbitantly expensive and was disappointed with the company’s use of “price points” to charge more for things that shouldn’t realistically cost that much.

Some customers have had reason to file claims with World2Cover and found the process to be slow and frustrating. One person who had to pay for a new flight after theirs was cancelled was disappointed when World2Cover failed to pay out on their claim for the expense. Emails went unanswered, leaving the customer feeling ignored.

If you’re considering World2Cover for your next trip, it’s important to weigh the pros and cons. Some customers have had great experiences with the company, finding them honest and helpful in their time of need. Others have had frustrating experiences with delayed claims and high prices. As with any insurance provider, it’s important to read the fine print and understand exactly what your policy covers before committing.

5. Terms and Conditions of World2Cover Policies

World2Cover is a travel insurance provider that offers five different policies, including Top Cover, Essentials Cover, Basics Cover, Annual Multi-Trip, and Domestic. The Top Cover policy, which is the most comprehensive plan, provides unlimited protection for overseas medical evacuation, cancellation fees, and emergency expenses. However, COVID-19 cover is only available under this policy and has some general exclusions for specific circumstances.

For those concerned about COVID-19, World2Cover is among the providers that offer some protection. It covers COVID-19 related overseas medical, hospital, and emergency expenses, but only under the Top Cover policy. There is limited cover for cancellation or amendment of travel plans and travel delays, but these are also available only under the Top Cover and Domestic policies. It is essential to confirm the specifics with the provider before making any decisions.

When purchasing any travel products, customers should review the Terms and Conditions and Product Disclosure Statement (PDS). World2Cover’s PDS contains detailed information about the terms and conditions, limits, and exclusions that apply to each policy and its benefits. It also outlines the target market and eligibility criteria for each policy. A copy of the Supplementary PDS and PDS for each travel product is available on their website.

World2Cover policies have general exclusions for certain circumstances under COVID-19 cover, such as travel to a country subject to Do Not Travel advice on the DFAT website. The provider should never honour a claim if the customer is deemed to be acting irresponsibly at the time of the incident, breaking the law, or participating in dangerous activities. Before making a claim, customers must ensure they meet all eligibility criteria and have the necessary documents to support their claims.

World2Cover is available to travelers up to 75 years of age, and children can be covered under their parents’ policies. The excess amount, which is the amount customers must pay when making a claim, can be reduced to $100 or $0 by paying an additional premium. While policies won’t include everything, customers can pay an additional premium to add extra cover to their policies. However, customers must read the fine print to understand what is and isn’t covered.

World2Cover sets out specific obligations for policyholders, such as notifying the company as soon as possible of hospital admittance, obtaining medical treatment from the treating doctor or consulting medical officer, and obeying local laws and regulations when traveling. Customers can make a claim conveniently and quickly online using World2Cover’s online claim lodgement service, and claims should be assessed within ten working days.

6. Target Market and Eligibility Criteria for World2Cover Travel Products

World2Cover is an award-winning travel insurance company that offers a range of travel products. However, before purchasing any travel products, it is important to review the Target Market and Eligibility Criteria that apply to these products. This includes reviewing the Terms and Conditions, as well as the Product Disclosure Statement (PDS). These documents outline the intended class of customers that comprise the target market for these travel products, including key attributes of the insurance cover and eligibility criteria. It is important to note that a Target Market Determination (TMD) does not replace the terms and conditions nor the disclosures made in a PDS, so it is essential to read the applicable PDS carefully and contact World2Cover if there are any queries. Additionally, a copy of the Supplementary PDS and TMD for each travel product can be found on the World2Cover website.

One of the standout features of World2Cover travel insurance is its Top Cover policy, which provides unlimited protection for overseas medical evacuation, cancellation fees, and emergency expenses. However, COVID-19 cover might not be enough for some travellers. While World2Cover offers unlimited cover for COVID-19 related to overseas medical, hospital, and emergency expenses, this coverage only applies to the Top Cover policy. If you have to cancel or amend your travel plans or experience a travel delay, there is also a limited amount of cover under the Top Cover and Domestic policies. However, since there are general exclusions for some specific circumstances under its COVID-19 cover, it is essential to review these exclusions before purchasing a policy.

World2Cover has a total of five different plans available, including its Top Cover, Essentials Cover, and Basics Cover, which will cover travellers for overseas trips. Additionally, World2Cover offers an annual multi-trip and domestic plan. With each plan, there is a required excess amount that must be paid when making a claim. However, this excess can be reduced to $100 or $0 when an additional premium is paid.

It is important to note that while World2Cover offers a range of features, these features may not include everything that travellers require. If there is something that is not covered as standard, it may be possible to pay an additional premium to add extra coverage to a policy. Some of the additional coverage that can be added includes illness, injury, delay, or cancellation coverage; cover for luggage that exceeds the standard limit; and coverage for skiing-related activities.

Overall, World2Cover is an appealing travel insurance provider that offers a range of coverage options. However, before purchasing a policy, it is important to carefully review the eligibility criteria and compare different policies based on individual requirements. With its focus on providing protection for overseas medical, hospital, and emergency expenses, World2Cover is an excellent choice for travellers who require this type of coverage.

7. Supplementary PDS and Policy Wording Available Online

World2Cover travel insurance is a product of Tokio Marine & Nichido Fire Insurance Co Ltd, which has won the Travel Insurance Company of the Year award in 2019 and 2022. The coverage is available from Monday to Friday, 8 am to 9 pm, and on weekends from 9 am to 6 pm. It is important to note that before purchasing any travel products, one must review the product disclosure statement (PDS) and the target market determination (TMD) that apply to those products. The TMD outlines the intended class of customers and the eligibility criteria for the insurance cover. While the PDS provides details of the terms and conditions, limits, sub-limits, and exclusions that apply to each of their policies and the different benefits.

One of the main selling points of World2Cover insurance is its Top plan, which provides unlimited protection for overseas medical evacuation, cancellation fees, and emergency expenses. However, it is essential to note that COVID-19 cover may not be enough for some travellers. The Top Cover policy offers unlimited cover for COVID-19 related to overseas medical, hospital, and emergency expenses. Still, its policies have general exclusions for some specific circumstances under its COVID-19 cover. For instance, travel to a country subject to Do Not Travel advice on the Smart Traveller website may not be covered.

Moreover, World2Cover travel insurance offers five different plans, including Top Cover, Essentials Cover, Basics Cover, annual multi-trip plan, and domestic plan. It is important to keep in mind that the excess amount is the amount that you are required to pay towards the claim. You can reduce it to $0 or $100 by paying an additional premium. While World2Cover may not include everything in its standard coverage, one may add extra cover by paying an additional premium.

In the event of illness, injury, delay, or cancellation, World2Cover’s insurance policy will cover you. If you are traveling with luggage that exceeds the limits, you can increase your cover on a per-item basis. Besides, if you plan to go skiing, coverage that includes ski equipment hire, prepaid ski passes, ski hire or lift passes, and tuition fees is necessary. However, some standard exclusions apply, and World2Cover will not honour claims if the traveller is deemed to be acting irresponsibly, under the influence of drugs or alcohol, doing something illegal, or travelling against the government’s advice.

If you need to make a claim with World2Cover insurance, the quickest and most convenient way is to do it online through its online claim lodgement system, where you can upload relevant documents. The claim should be assessed within ten working days. Travellers up to 75 years of age are eligible for World2Cover travel insurance. Children can also be covered under their parent’s policy.

In conclusion, World2Cover’s travel insurance has received multiple awards and provides different policy options with varied coverage. However, it is essential to review the product disclosure statement (PDS) and the target market determination (TMD) to see if one’s objectives, financial situation and needs are covered by their policies. Overall, World2Cover travel insurance provides compelling offers that may suit various travellers’ needs.

8. Unlimited Overseas Medical and Hospital Coverage

World2Cover has been reviewed on ProductReview.com.au, with mixed feedback from its customers. One individual had issues with lodging a claim for accommodation after a missed flight, with the process taking two months to resolve. They were only reimbursed a small amount due to several technicalities, and they do not recommend using the company. Another individual, however, experienced amazing service when they needed to cancel their travel insurance policy. World2Cover responded promptly to their email request and refunded their payment within minutes. The individual commended the company for its exceptional customer focus.

Another customer incurred unexpected expenses when the return date on their 21-day policy needed to be amended by one day, which ended up costing an additional $147.43. They were unhappy with the company’s use of “price points,” which resulted in them paying for extra coverage they neither wanted nor could use. Despite this negative experience, the company’s customer service team responded professionally and offered to review the matter further.

World2Cover has won multiple Travel Insurance Awards and was named Travel Insurance Company of the Year in 2019 and 2022. The company is underwritten by Tokio Marine & Nichido Fire Insurance Co Ltd, which is regulated by the Australian Securities and Investments Commission (ASIC). The company’s customer service is available from Monday to Friday, 8am to 9pm, and on weekends from 9am to 6pm.

World2Cover offers unlimited overseas medical and hospital coverage, covering reasonable expenses incurred as a result of an injury or illness during the period of insurance. Benefits may be paid up to 12 months from the time of treatment, subject to the specific terms, conditions, and exclusions. It is crucial to review the product disclosure statement (PDS) and target market determination (TMD) before purchasing any travel products to have a clear understanding of the policy’s limits, benefits, and exclusions. All medical treatments must be provided by a treating doctor or the company’s consulting medical officer, and the company must be notified of hospital admittance as soon as possible. In summary, World2Cover may be an excellent travel insurance choice for those seeking unlimited overseas medical and hospital coverage, but it is essential to read the PDS and TMD thoroughly before committing.

9. Notification Requirements for Hospital Admittance

World2Cover Travel Insurance offers coverage for unexpected medical emergencies during travel. With their customer-oriented approach and multiple awards received, they aim to provide comprehensive coverage that suits everyone’s travel needs. The coverage hours are from Monday to Friday – 8 am to 9 pm and on weekends, from 9 am to 6 pm. However, before purchasing, travelers must review the terms and conditions, limits, and exclusions that apply to each policy. Moreover, it is essential to note that their Travel Medical Insurance has no cap on the maximum dollar amount payable, subject to the specific terms and conditions, sublimits, and exclusions. In case of hospital admittance while on a trip, the traveler must notify World2Cover as soon as possible.

Travelers’ experiences with World2Cover vary from claims being handled professionally to claims receiving poor treatment and processing. One customer reported lodging a claim for accommodations connected with a missed flight that took two months to resolve and being reimbursed a small sum because of various technicalities. However, World2Cover representatives apologized for the customer’s negative experience and promised to review their case and rectify the situation. Another customer praised World2Cover for their customer-focused approach, receiving a quick response when requesting a policy cancellation.

World2Cover’s policy pricing methods have received negative comments as well. One traveler paid for a premium but realized that the return day was out by a day. Upon contacting the company, they advised the traveler to add one day, which added $147.43 to their existing $510.21, making it the cost of six days. The company explained using price points, but the traveler felt raked for five extra days of useless coverage. The traveler recommended other companies worth investigating before committing to a policy.

Another traveler reported experiencing a stressful situation where the airline canceled their flight and failed to provide an alternate option or refund. World2Cover did not respond to the email, and after seven months of attempting to contact them, the customer received no payment from their claim. However, World2Cover responded to the feedback and apologized for the customer’s negative experience, explaining that the email address provided was incorrect.

World2Cover’s positive reviews outweigh the negative ones, with one customer expressing gratitude for how they handled their situation in Canada. After the customer’s husband had an accident, World2Cover arranged for them to fly back to Australia business class and paid all their expenses, including medical and cancellations. They received payment within ten days after making their claim. Overall, World2Cover seems to be a helpful and honest travel insurance company that provides excellent service.

10. Customer Support and Contact Information

World2Cover provides a wide range of travel insurance policies and contact options depending on whether you’re traveling or back home in Australia. Their customer support is available Monday to Friday, 8.00am-9.00pm AEST and Saturday to Sunday 9.00am-6.00pm AEST, making it easy to get in touch whenever you need assistance. You can quickly lodge a claim with their online claim lodgement link, available 24/7. Customer support is also available in case of an emergency overseas, with a toll-free number available to call. They also offer an email and phone option for those who wish to make a complaint or seek assistance.

One customer reported a disappointing experience with World2Cover when it took two months to resolve a claim for accommodation related to a missed flight. While World2Cover reimbursed the customer, it was a small amount due to various technicalities. However, World2Cover has assured the customer that they will investigate the issue and try to rectify any outstanding problems. Another customer had a positive experience with the company, stating that their customer service was amazing and that their funds were returned promptly when they cancelled their policy.

However, some customers have reported issues with the cost of adding extra days to their policy, while others claimed that they never received payment on their claim despite trying to contact the company for several months. World2Cover has stated that they take all complaints seriously and are constantly looking for ways to improve their customer experience. They encourage customers to reach out to them for assistance, either by email or phone, to help rectify any issues.

Overall, World2Cover appears to be a reliable and trustworthy travel insurance provider with excellent customer support options for those in need. While some customers may have experienced issues in the past, the company appears to be actively trying to address any concerns and provide the best possible service to its customers. Before purchasing any travel products, customers are encouraged to review their policies, terms, and conditions, and contact World2Cover if they have any questions or concerns.