Navigating the world of travel insurance is often more stressful than the trip itself. As a travel expert who has spent over 15 years exploring every corner of the globe—from the bustling markets of Marrakesh to the serene vineyards of the Loire Valley—I’ve learned that the “best” insurance isn’t the one with the flashiest website; it’s the one that actually pays out when your flight is canceled at 2:00 AM in a foreign airport.

Today, we are taking a deep dive into World2Cover Travel Insurance. Issued by the heavyweight Tokio Marine & Nichido Fire Insurance Co Ltd, this provider has caught the eye of many Australian travelers. But with a mix of prestigious awards and polarizing customer reviews, does it live up to the hype in 2025?

1. The World2Cover Persona: Who Are They?

World2Cover isn’t just another faceless digital startup. They are backed by one of the world’s largest insurance groups, which gives them a level of financial stability that smaller “budget” insurers lack. They have consistently been recognized in the industry, winning the Travel Insurance Company of the Year award in both 2019 and 2022.

However, as any seasoned traveler will tell you, an award on a mantlepiece doesn’t help you when you’re stuck in a hospital in Canada. To truly understand this provider, we need to look at the World2Cover reviews and the fine print of their current 2025 policies.

Pro-Tip: Always check the “Financial Services Guide” (FSG) and the “Product Disclosure Statement” (PDS) before buying. World2Cover makes these available online, and they are the only documents that legally matter when it comes to your claim.

2. Choosing Your Shield: World2Cover Policy Breakdown

In 2025, World2Cover offers five distinct tiers of coverage. Choosing the right one is the difference between being fully reimbursed and being left out of pocket.

The Comparison: Top Cover vs. The Rest

| Feature | Top Cover | Essentials | Basics |

| Overseas Medical | Unlimited | $10M | $5M |

| Cancellation Fees | Unlimited | $10,000 | Nil |

| COVID-19 Cover | Included | Limited | Nil |

| Luggage & Personal Effects | High Limits | Mid Limits | Low Limits |

| Best For | International families & Seniors | Budget-conscious solo travelers | Minimalist backpackers |

The “Unlimited” Promise

The World2Cover Top Cover is their flagship product. It offers “unlimited” protection for overseas medical evacuation and cancellation fees. In the insurance world, “unlimited” usually means there is no pre-set dollar cap, but it is still subject to “reasonable expenses” as determined by their consulting medical officers.

3. The Elephant in the Room: COVID-19 Coverage in 2025

While the world has moved on, travel insurance hasn’t. In 2025, World2Cover travel insurance review discussions almost always center on pandemic protections.

What you need to know:

-

Top Cover is King: COVID-19 medical and hospital expenses are primarily covered under the Top Cover policy.

-

Limited Cancellation: You may have limited cover for cancellation if you or your travel companion contract COVID-19, but this is usually restricted to the Top Cover and Domestic plans.

-

The “DFAT” Exclusion: If the Australian Department of Foreign Affairs and Trade (DFAT) issues a “Do Not Travel” warning for your destination, your COVID-19 cover is likely void.

4. World2Cover Reviews: The Good, The Bad, and The Ugly

Search Console data shows that world2cover travel insurance reviews are a top priority for researchers. Why? Because the feedback is incredibly “split.“

The Bright Side: Swift Service and Integrity

Many travelers report “amazing” service. One standout case involved a traveler who realized they had overlapping cover through a union membership. World2Cover processed a quick refund within minutes. Another customer in Canada praised the company for flying them back to Australia in business class after a major accident, settling all medical and cancellation expenses within 10 days of the claim.

The Dark Side: Claims and “Price Points”

On platforms like ProductReview.com.au, some users express frustration. Common complaints include:

-

Slow Claims Processing: Some travelers waited over two months for a missed flight claim, only to be reimbursed a fraction of the cost due to “technicalities.“

-

Pricing Oddities: One traveler was charged $147.43 to add just one day to a 21-day policy. The company cites “price points” (tiered pricing), but for the consumer, it can feel like being taken advantage of.

-

Communication Gaps: Reports of unanswered emails during stressful flight cancellations are a recurring theme.

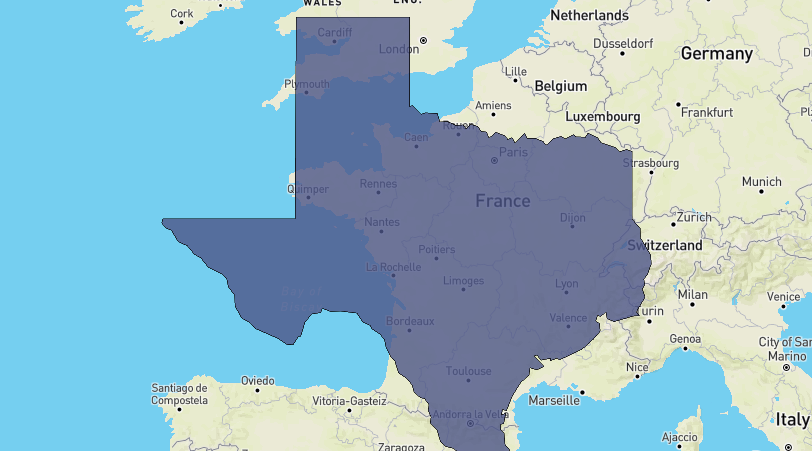

Local Expert Insight: Most “technicality” denials happen because the traveler didn’t obtain a written report from the airline or a “treating doctor” at the time of the incident. In France, for example, always get a procès-verbal (official report) from the police or transport authority immediately.

How to Ensure Your Claim is Paid

To avoid becoming a negative world2cover review, follow these non-negotiable steps:

-

Notify Immediately: If you are admitted to a hospital, you (or someone on your behalf) must notify World2Cover as soon as possible.

-

Use Their Doctors: All medical treatment must be provided by a “treating doctor” or the company’s consulting medical officer.

-

Obey Local Laws: Engaging in illegal acts or acting irresponsibly (like driving a scooter in Bali without a valid license) will void your claim instantly.

-

Keep the Paperwork: Lodging a claim is easiest through the World2Cover online claim lodgement service, but you’ll need to upload digital copies of all receipts and reports.

Targeted Eligibility: Are You Covered?

World2Cover has a specific Target Market Determination (TMD).

-

Age Limit: Generally available for travelers up to 75 years of age.

-

Children: Dependent children and grandchildren can often be covered under their parents’ or grandparents’ policy at no extra cost (check the specific PDS for “Top Cover”).

-

Pre-existing Conditions: Like most insurers, pre-existing medical conditions must be disclosed and may require an additional premium or be excluded entirely.

FAQ: Answering Your Burning World2Cover Questions

Is World2Cover a reputable company?

Yes. It is issued by Tokio Marine & Nichido Fire Insurance Co Ltd, a highly regulated and stable global insurer. They have won “Travel Insurance Company of the Year” multiple times.

Does World2Cover cover COVID-19?

Yes, but primarily under the Top Cover policy. It covers medical expenses and has limited cover for cancellations or delays related to COVID-19. Always read the Supplementary PDS for the latest updates.

How do I contact World2Cover in an emergency?

They offer 24/7 emergency assistance. You can find their toll-free international numbers on your policy certificate. For general inquiries, they are available Monday-Friday (8 am – 9 pm AEST) and weekends (9 am – 6 pm AEST).

Can I reduce my excess?

Yes. You can choose to reduce your excess to $100 or $0 by paying an additional premium upfront. This is highly recommended for peace of mind.

What is excluded from World2Cover?

Standard exclusions include “Do Not Travel” destinations, high-risk sports (unless added as an extra), and incidents occurring while under the influence of drugs or alcohol.

How long does it take to process a claim?

World2Cover aims to assess claims within 10 working days, provided all documentation is submitted correctly via their online portal.

The Verdict: Is World2Cover Right for You?

World2Cover is an excellent choice for travelers who want the backing of a major global insurer and are willing to pay for Top Cover to get “unlimited” medical and cancellation benefits.

However, if you are looking for the absolute cheapest “Basics” cover, or if you need to add just one extra day to a trip, you might find their “price point” system frustrating.

The Bottom Line: If you choose them, read the PDS twice, document everything during your trip, and stick to the Top Cover for the best experience.

Planning a trip to France or Europe? Explore SeaFranceHolidays.com for local guides, hidden gems, and more expert travel insurance comparisons.

Pingback: Best Campsites Ile de Re: Eurocamp Ile de Re, Huttopia & Top Île de Ré Camping Guide | SeaFranceHolidays