Travel insurance often hides in the fine print of your bank account—until you need it. NatWest Platinum travel insurance stands out among packaged accounts, offering worldwide coverage bundled with everyday banking perks that savvy travellers rely on. This comprehensive guide from SeaFranceHolidays.com breaks down NatWest Platinum account benefits, explains what NatWest travel insurance covers, and walks through NatWest travel insurance claim processes for real-world peace of mind.

NatWest Packaged Accounts: Travel Insurance That Pays for Itself

NatWest structures travel insurance through tiered accounts—Silver, Platinum, and Black—each unlocking escalating protection levels. Natwest Platinum benefits kick in with worldwide coverage for you, your partner, and dependent children under 18 (or 23 if in full-time education). Natwest platinum account travel insurance automatically activates when you pay for trips using your NatWest card, covering medical emergencies up to £10 million, cancellations to £5,000, and baggage to £2,500.

Lower tiers like natwest silver travel insurance limit to Europe, while natwest black travel insurance elevates to worldwide excluding USA/Canada (upgrade available). Natwest platinum shines for frequent flyers: no single-trip limits, winter sports standard, and 24/7 global assistance. Pro Tip: Switch to Platinum (£11/month) if you travel twice yearly—the insurance alone justifies the fee versus standalone policies averaging £25/trip.

Packaged accounts bundle extras: natwest platinum phone insurance covers gadgets up to £1,000, natwest black phone insurance doubles it. Natwest platinum account breakdown cover includes roadside rescue worldwide. Review natwest.com platinum benefits online—downloadable policy documents detail excesses (£150 medical, £250 cancellation).

What NatWest Platinum Travel Insurance Covers: Key Protections Explained

Natwest travel insurance policy documents outline robust safeguards. Core natwest platinum travel insurance coverage includes:

-

Medical Expenses: Unlimited hospital stays, repatriation—crucial without reciprocal healthcare agreements.

-

Trip Cancellation/Interruption: Up to £5,000 per person for illness, redundancy, or travel supplier failure.

-

Baggage & Money: £2,500 possessions, £500 cash/documents; natwest platinum mobile insurance adds £1,000 electronics.

-

Personal Liability: £2 million legal protection.

-

Winter Sports: Piste closure, equipment hire—natwest platinum account breakdown cover extends to ski resorts.

Natwest holiday insurance activates for single trips up to 120 days or annual multi-trips (31 days max each). Natwest black account travel insurance matches Platinum but adds concierge services. What is covered by natwest travel insurance? Everything from missed departures (£250/day after 12 hours) to personal accidents (£25,000 death benefit).

Comparison Table: NatWest Account Travel Insurance Levels

| Coverage Type | Silver (Europe) | Platinum (Worldwide) | Black (Worldwide Plus) |

|---|---|---|---|

| Medical Limit | £5m | £10m | £15m |

| Cancellation | £2,500 | £5,000 | £10,000 |

| Baggage | £1,500 | £2,500 | £3,000 |

| Phone Insurance | None | £1,000 | £2,000 |

| Family Cover | Account Holder Only | Full Family | Full Family + Students |

| Annual Fee | £6.99/mo | £11/mo | £24/mo |

NatWest Packaged Insurance at a Glance

| Feature | Silver Account | Platinum Account | Black Account |

| Geographic Scope | Europe Only | Worldwide | Worldwide Plus |

| Cover Type | Individual/Joint | Family Cover | Family Cover |

| Winter Sports | Available | Included (Check Policy) | Included |

| Max Age (Standard) | Under 70 | Under 70 | Under 70 |

| Monthly Fee | Low | Medium | High |

Natwest platinum travel insurance policy number appears on your app/dashboard—keep screenshots handy.

NatWest Platinum Account Benefits Beyond Travel Insurance

Natwest platinum account benefits extend far: fee-free overseas spending, airport lounge access (4 visits/year), and natwest platinum insurance wrapping home contents (£50,000). Natwest platinum phone insurance covers loss/theft/damage; natwest black insurance adds screen repair vouchers.

What does natwest platinum account cover? Comprehensive mobile banking fraud protection, purchase protection (£1,000/item), and extended warranties. Natwest platinum account phone insurance rivals standalone policies—claim via app for replacements within 48 hours. Natwest select platinum account benefits mirror core Platinum for new customers.

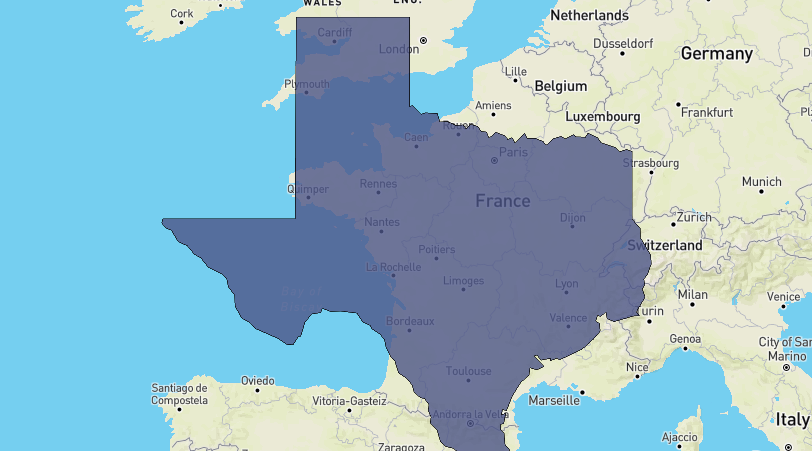

For gadgets, natwest platinum mobile insurance covers up to 2 devices; natwest black card travel insurance bundles it with priority claims lines. Everyday perks like natwest benefits travel insurance make Platinum ideal for Europe-France trips via SeaFranceHolidays.com itineraries.

Making a NatWest Travel Insurance Claim: Step-by-Step Process

Natwest travel insurance claim starts online—fastest route via app/portal. Natwest travel insurance phone number (0345 609 9111) handles urgent queries; natwest travel insurance contact number same for claims team (Mon-Fri 8am-8pm).

Claim Steps:

-

Notify Immediately: Within 24 hours for medical, 7 days for baggage/theft.

-

Gather Evidence: Receipts, police reports, medical notes.

-

Submit Online: Upload via natwest travel insurance contact portal—80% processed in 10 days.

-

Track Progress: App notifications; natwest holiday insurance claim averages £1,200 payout.

Natwest travel insurance contact warns: first seek refunds from airlines/hotels under ATOL/ABTA. Natwest platinum travel insurance policy document mandates original receipts. Common wins: £300+ delayed baggage, £1,500 medical evacuations.

Special Cases: Over 70s, Pre-Existing Conditions & Coronavirus

Natwest platinum account travel insurance requires annual £75/person extension for over-70s—call natwest platinum account breakdown cover team. Pre-existing conditions? Declare upfront; coverage varies but often £10m medical post-assessment.

Coronavirus travel insurance natwest covers pandemics per latest FCDO advice—quarantine (£100/day), trip curtailment if government-mandated. Natwest platinum travel insurance policy document details COVID exclusions (known events). Natwest silver account travel insurance matches for Europe.

Pro Tip: Download natwest platinum travel insurance policy document pre-trip; app stores digital copy.

NatWest Black Account: Premium Travel Insurance Upgrades

Natwest black travel insurance elevates with £15m medical, £10k cancellation, natwest black insurance gadget cover to £2k. Natwest black account travel insurance includes VIP lounges (unlimited), concierge bookings. Natwest black card travel insurance suits high-net-worth travellers—claim natwest travel insurance policy number instantly via digital wallet.

Natwest reward platinum travel insurance (legacy) mirrors current Platinum; natwest rewards travel insurance phased out but transferable.

Phone & Mobile Insurance: NatWest Platinum Perks

Natwest platinum phone insurance covers iPhones/Samsungs up to £1,000—accidental damage, theft. Natwest platinum mobile insurance claims via photo upload; 24hr replacement. Natwest black phone insurance doubles limits, adds global cover.

Compare: Standalone policies £10/month vs. bundled natwest platinum benefits—switch if travelling quarterly.

Practical Tips: Maximizing Your NatWest Travel Insurance

-

Activate Coverage: Pay any travel leg with NatWest card.

-

Declare Everything: Pre-existing via natwest travel insurance platinum form.

-

Claims First Steps: Natwest travel insurance contact before spending out-of-pocket.

-

France Travel: EHIC+ supplements natwest holiday insurance for EU medical gaps.

Booking SeaFranceHolidays.com packages? Natwest bank travel insurance pairs perfectly—covers ferries, missed connections.

How to Make a NatWest Travel Insurance Claim Without the Headache

The true test of an insurance policy is the claims process. Having dealt with numerous claims on behalf of clients over the years, I can tell you that “Organization is King.”

Step-by-Step Claims Checklist:

-

Get the Policy Number: Your natwest platinum travel insurance policy number is usually your bank account number and sort code, but check your digital welcome pack to be sure.

-

Contact Immediately: For medical emergencies, call the 24/7 emergency assistance line before committing to major surgeries if possible.

-

Police Reports: If your bags or phone are stolen, you must get a police report within 24 hours. Without this “paper trail,” most claims will be rejected.

-

Proof of Loss: Keep receipts for anything you have to buy (emergency clothes, etc.) and keep all correspondence from the airline if they lose your bags.

-

Use the Online Portal: NatWest’s claims are often handled faster through their digital submission forms rather than via post.

NatWest vs. The Market: Is the Packaged Account Worth It?

A common question is: “Should I keep my Platinum account or just buy standalone insurance from a site like InsureandGo or Allianz?”

The Math of Packaged Accounts

If you pay, for example, £20 a month for a Platinum account, that’s £240 a year.

-

Standalone Travel Insurance (Family Worldwide): ~£80 – £120.

-

UK & EU Breakdown Cover: ~£60 – £100.

-

Mobile Phone Insurance (2 phones): ~£120 – £150. Total Value of Separate Services: £260 – £370.

As you can see, if you use at least two of the core benefits (Travel + Phone or Travel + Breakdown), the account pays for itself. If you only want travel insurance and never drive or lose your phone, you are likely better off with a standalone policy from a provider like SafetyWing (great for digital nomads) or a specific holiday insurer.

FAQ: Navigating Your NatWest Travel Insurance Queries

What is the NatWest travel insurance contact number?

You can usually find the most up-to-date natwest travel insurance phone number on the back of your debit card or within the NatWest mobile app under the “Rewards” or “Insurance” tab. For emergency medical assistance while abroad, there is a dedicated 24-hour line listed in your policy document.

Does NatWest Platinum cover mobile phone insurance?

Yes. NatWest platinum phone insurance is a standard benefit. It typically covers the account holder’s phone and, in some cases, the partner’s phone if it’s a joint account. You must register your handset details (IMEI number) with the bank to ensure a smooth claims process.

Where can I find the NatWest platinum travel insurance policy document?

The most efficient way to access the natwest platinum travel insurance policy document is through the NatWest online banking portal or the mobile app. Look for the “Membership Services” or “Account Benefits” section. It is highly recommended to save a PDF copy to your phone before you travel, as you may not have reliable data in remote areas.

Does the NatWest Silver account include travel insurance?

Yes, natwest silver account travel insurance is included, but it is typically restricted to European destinations. If you are planning a trip to the US, Asia, or Australia, you would need to upgrade to the Platinum or Black account or purchase a separate worldwide add-on.

How do I handle a NatWest travel insurance claim for a cancelled flight?

First, seek a refund or rebooking from the airline. If they refuse and provide a “Letter of Denial,” you can then proceed with a natwest holiday insurance claim. You will need to provide your booking confirmation, the airline’s cancellation notice, and evidence of any non-recoverable costs.

What is covered by NatWest Platinum account breakdown cover?

This typically provides “Home Start,” “Roadside Assistance,” and “Recovery” within the UK. Many versions of the Platinum and Black accounts also extend this to European breakdown cover, which is essential for cross-channel driving holidays. Always check your specific natwest platinum account breakdown cover terms for vehicle age and weight limits.

Is NatWest Select Platinum account benefits the same as Reward Platinum?

NatWest often rebrands its accounts (e.g., Select Platinum vs. Reward Platinum). While the core natwest platinum benefits like travel and phone insurance usually remain consistent, the “Reward” versions often include a cashback element on household bills. Always verify your specific account name in your bank statement.

Final Thoughts: The Expert Verdict

The NatWest Platinum Travel Insurance policy is a robust, “heavy-duty” product that offers incredible value for the modern family. It removes the friction of buying a new policy every time you want to hop on a ferry or book a flight.

However, its “set it and forget it” nature is its only weakness. Travelers over 70 and those with medical conditions must remain proactive. By treating your bank insurance as a “living” document—updating it with your health changes and age milestones—you can ensure that the only thing you have to worry about on your next trip is whether to have another croissant or a second glass of Vin Rouge.

For more expert guides on European travel logistics and the best-kept secrets of France, explore the rest of SeaFranceHolidays.com.

Strategic Integration Note: To maximize your travel safety, consider pairing your NatWest cover with a reliable global booking platform. When planning your French itineraries, using established operators like Booking.com for flexible cancellations or GetYourGuide for curated tours ensures you have the documentation needed should an insurance claim ever arise. Always keep your digital receipts organized in a dedicated “Travel” folder in your email—it’s the first thing an insurer will ask for.