Alaska Airlines is a popular choice among travelers, especially those who frequently fly to and from destinations around the Pacific Northwest. The Alaska Airlines Credit Card is one way to make the most out of your travels with a variety of benefits and rewards. However, before you apply for this card, it’s important to understand the interest rates and Visa fees associated with it. In this blog post, we’ll take a closer look at these fees and provide some tips on how you can maximize your benefits while minimizing your costs. So buckle up, sit back, and let’s dive into the details of Alaska Airlines Credit Card Interest Rates & Visa Fees.

Table of Contents

1. Introduction to Alaska Airlines Credit Card

If you’re looking for an airline credit card that offers generous rewards and a convenient travel experience, the Alaska Airlines Visa Signature card might be the right choice for you. This credit card comes with 50,000 bonus miles and a $100 statement credit after qualifying purchases, making it an appealing option for frequent flyers.

-

Standard APR Range

As with most credit cards, the Alaska Airlines Visa Signature card offers a range of standard APRs, starting from 19.74% and going up to 27.74%, depending on your creditworthiness. It’s important to consider this range when using the card and plan ahead so that you can avoid high-interest charges.

-

Annual Fee and Waivers

The card does come with an annual fee of $95, but waivers are available, depending on your usage frequency. For those who frequently fly with Alaska Airlines, this fee can be worthwhile to earn rewards and benefits, such as a free checked bag and priority boarding.

-

Balance Transfer Fee

The Alaska Airlines Visa Signature card charges a 3% balance transfer fee, so it’s important to factor in this cost when deciding whether to transfer balances or pay off debts.

-

Introductory APR Offer

Unfortunately, the card does not offer an introductory APR, but it does offer 0% intro APR for 15 months on balance transfers made within the first 60 days of account opening. If you need to make a balance transfer, this could be a good opportunity to save on interest costs.

-

Variable APR Range

The variable APR range for the Alaska Airlines Visa Signature card is between 19.74% and 27.74%, with the actual APR depending on your creditworthiness, making it important to maintain good credit to keep interest rates lower.

-

Creditworthiness and APR

Your creditworthiness is a major factor in determining the APR you’ll receive with the Alaska Airlines Visa Signature card. Maintaining a favorable credit score will help ensure you get the most out of this card by giving you a low-interest rate.

-

Payment Cycle and APR

Keep in mind that the payment cycle and APR will also impact your interest charges, so be sure to make your payments on time to avoid penalties and higher rates.

-

Foreign Transaction Fees

The Alaska Airlines Visa Signature card has a foreign transaction fee of up to 3% per transaction when used outside of the U.S. This may not be ideal for those who travel internationally frequently.

-

Companion Fare and Bonus Miles Offer

As an added incentive, the Alaska Airlines Visa Signature card also comes with a companion fare offer and a bonus miles offer. The companion fare enables you to bring a travel companion for only $99 (plus taxes and fees) once per year. The bonus miles offer includes a 50,000 miles signup bonus and a $100 statement credit after qualifying purchases.

Overall, the Alaska Airlines Visa Signature card is a great option for frequent flyers who fly with Alaska Airlines. It comes with generous rewards and benefits, making it a viable choice for those who want to travel in style while earning rewards for their spending. Be sure to consider the APR range and annual fee before applying for this card, and use it responsibly to make the most of your rewards.

2. Standard APR Range

Now, let’s take a closer look at the standard APR range for the Alaska Airlines Visa Credit Card. Depending on your creditworthiness, the variable APR can range from 19.74% to 27.74% for both purchases and balance transfers. This means that if you carry a balance on your card, it can potentially accumulate interest at a high rate.

However, if you pay off your balance on time and in full every month, the APR should not be a major concern. Plus, the card offers a limited-time online offer of a $100 statement credit and 50,000 bonus miles, which can offset the annual fee of $95.

It’s important to note that your creditworthiness can play a significant role in your APR. If you have a good credit score, you may be able to qualify for a lower APR. On the other hand, if your credit score is lower, you may receive a higher APR.

In addition to the APR, it’s also important to consider the payment cycle. This card offers a grace period of at least 25 days from the close of each billing cycle to the payment due date. This means that if you pay off your balance in full within this period, you can avoid accruing interest.

Overall, the Alaska Airlines Visa Credit Card offers a competitive rewards program and a decent standard APR range. However, it’s important to consider your creditworthiness and payment habits before applying for any credit card. With the $100 statement credit and 50,000 bonus miles offer, this card could be a great option for frequent Alaska Airlines flyers.

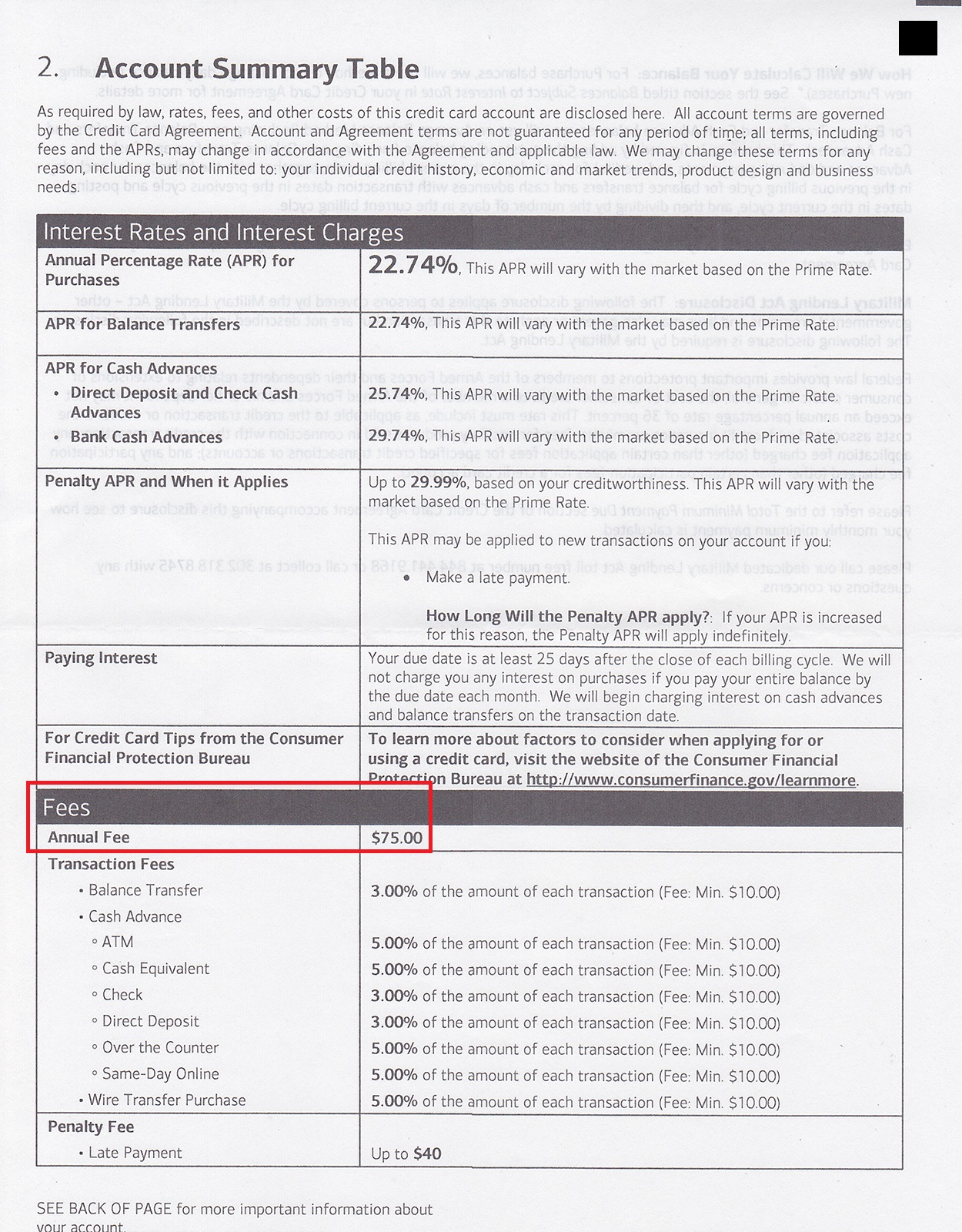

3. Annual Fee and Waivers

One of the vital details cardholders should consider before applying for a credit card is the annual fee. The Alaska Airlines Visa Signature® card charges a $95 annual fee, which may seem high at first glance. However, when paired with the benefits and bonuses, it proves to be a worthy investment.

For example, the card provides access to discounts, bonuses, and preferred boarding on Alaska Airlines flights, which can be a significant advantage when traveling frequently. Additionally, cardholders can earn 3X miles on Alaska Airlines purchases and receive 50,000 bonus miles with a qualifying purchase. That’s a potential value of over $500 if redeemed correctly.

Furthermore, Alaska Airlines Visa Signature® offers an annual statement credit of $100, which can offset the annual fee, making it more affordable. You can use this credit for travel expenses or up to $100 off an annual Alaska Lounge Membership (typically $550 per year for elites, $650 per year for non-elites).

Alaska Airlines®, the issuing bank, offers a potential waiver of the annual fee for the first year for eligible applicants. Once the waiver period ends, maintaining your card’s active status can help you enjoy the many benefits of the Alaska Airlines Visa Signature® card.

Overall, if you’re a frequent traveler, the Alaska Airlines Visa Signature® card could save you hundreds of dollars and provide exciting perks. The annual fee is worth the investment, considering the miles, bonuses, access to discounts, preferred boarding, and statement credit.

4. Balance Transfer Fee

When considering the Alaska Airlines Credit Card, one important factor to take into account is the balance transfer fee. As with most credit cards, the Alaska Airlines card charges a fee for balance transfers, and this is set at 3% of the amount of each transaction. While this fee might seem small, it can add up quickly if you are transferring a large balance.

However, if you are able to pay off the balance quickly, the balance transfer fee can be a worthwhile investment. By transferring a balance to the Alaska Airlines card, you may be able to take advantage of the card’s lower APR range, which can help you save money on interest charges in the long run.

It’s important to note that the Alaska Airlines Credit Card does not currently offer an introductory APR on balance transfers. However, the card’s variable APR range is competitive, and the fee might still be worth it for some consumers.

When evaluating your options, it’s important to keep in mind that the Alaska Airlines Credit Card does come with a $95 annual fee. This fee might be offset by the card’s benefits, such as bonus miles and a companion fare, but it’s still important to take into account when calculating the overall cost of the card.

Ultimately, whether or not the balance transfer fee is worth it will depend on your individual financial situation, including your ability to pay off the balance quickly and your willingness to pay the annual fee. By carefully weighing the pros and cons of the Alaska Airlines Credit Card, you can make an informed decision about whether this card is the right choice for you.

5. Introductory APR Offer

As mentioned in our previous sections about the Alaska Airlines Visa Credit Card, the standard APR range for purchases and balance transfers ranges from 19.74% to 27.74% variable depending on creditworthiness. However, if you’d rather avoid accruing interest, there is an alternative option that may appeal to you.

The introductory APR offer for the Alaska Airlines Visa Credit Card is currently none, meaning there is no 0% APR period when you open an account. Though this may seem like a disadvantage, it’s important to note that the standard APR range for this card is still competitive within the mid-tier airline credit card market.

If you’re looking for an introductory APR offer, there are other credit cards on the market that may better suit your needs. However, if you’re a frequent Alaska Airlines traveler looking to earn bonus miles and take advantage of valuable perks like companion fare, the Alaska Airlines Visa Credit Card may still be a great choice for you.

Ultimately, it’s important to carefully consider your spending habits before opening a new credit card account and to choose a card that aligns with your long-term financial goals. The Alaska Airlines Visa Credit Card may not offer an introductory APR, but it does provide many valuable benefits for frequent travelers.

6. Variable APR Range

As we delve deeper into the Alaska Airlines Visa Credit Card, let’s take a closer look at the Variable APR Range. This credit card comes with a Standard APR, which can range from 19.74% to 27.74%, depending on your creditworthiness. It’s important to note that this APR applies to both purchases and balance transfers.

If you’re someone who carries a balance on your credit card, it’s crucial to pay attention to the Variable APR Range. You don’t want to be caught off guard by unexpected interest charges. This is where being familiar with your credit score and financial situation comes into play. If you have a good credit score and a steady income, you may be able to secure a lower APR.

Another factor that can impact your APR is the payment cycle. If you consistently make late payments or miss payments altogether, your APR may increase. It’s important to make at least the minimum payment on time each month to avoid penalty fees and potential damage to your credit score.

For those who frequently travel outside of the United States, it’s worth noting that the Alaska Airlines Visa Credit Card also charges Foreign Transaction Fees. These fees can add up quickly, so it’s important to be aware of the costs before using your credit card abroad.

While the Variable APR Range may seem daunting, it’s important to remember that this credit card also offers a Companion Fare and Bonus Miles Offer. If you fly Alaska Airlines frequently, the savings you can receive from these perks could outweigh the cost of the annual fee and potential interest charges.

In conclusion, the Alaska Airlines Visa Credit Card offers a Variable APR Range that is in line with other mid-tier airline credit cards. With a bit of financial planning and responsible credit card use, you can take advantage of this credit card’s benefits while avoiding unnecessary interest charges.

7. Creditworthiness and APR

When it comes to credit cards, one key factor that determines your interest rate is your creditworthiness. With the Alaska Airlines Visa Credit Card, this is no exception. As mentioned in previous sections, the card carries a variable APR range of 19.74% to 27.74%, and this rate is based on your creditworthiness.

If you have a good to excellent credit score, you may be able to qualify for the lower end of the APR range. However, if your credit score is fair or poor, you may be subject to the higher end of the range. It’s important to keep in mind that your creditworthiness can also affect your chances of being approved for the card altogether.

The payment cycle can also affect your APR. If you consistently make timely payments, you may be able to maintain a lower APR. However, if you miss payments or carry a balance, you could see an increase in your APR.

Despite the potential for a higher APR, the Alaska Airlines Visa Credit Card offers significant rewards and benefits, such as the free companion fare and bonus miles offer. Plus, the card doesn’t charge any foreign transaction fees, so it could still be a great option for frequent travelers.

Overall, if you have good credit and are able to pay off your balance in full each month, the Alaska Airlines Visa Credit Card could be a great option to earn rewards and take advantage of the various benefits offered. However, if you struggle with credit card debt, the card’s high APR could be a burden. It’s important to carefully consider your financial situation before applying for any credit card, and to always use credit responsibly.

8. Payment Cycle and APR

When it comes to the payment cycle and APR for the Alaska Airlines credit card, there are a few key things to keep in mind. As we’ve previously discussed, the standard APR range for this card is 19.74% – 27.74% variable, depending on your creditworthiness.

It’s important to note that interest will accrue on any balance you carry from month to month, so if you’re not able to pay off your balance in full each month, you’ll want to make sure you’re aware of the APR and the impact it will have on your balance.

One thing to keep in mind is that miles earned with this card will post to your account 7-10 days after the credit card statement, so if you’re trying to earn miles for a specific trip, you’ll want to make sure you’re making your purchases in time to get the miles credited to your account.

Another key feature of the Alaska Airlines credit card is the companion fare and bonus miles offer. If you’re able to use this perk each year, it can easily justify the $95 annual fee. However, it’s important to weigh the benefits of the card against the fees and interest rates to make sure it’s the right choice for you.

Ultimately, the Alaska Airlines credit card can be a great option for frequent flyers who are looking to earn rewards and take advantage of perks like the companion fare and bonus miles. However, it’s important to be aware of the fees and interest rates, and to make sure you’re using the card strategically to maximize your rewards and minimize your costs.

9. Foreign Transaction Fees

When it comes to traveling abroad, having a credit card with no foreign transaction fees is essential. Luckily, the Alaska Airlines Credit Card has got you covered with its 0% foreign transaction fee policy. This means that you won’t be charged anything extra when you make purchases outside the U.S.

One of the best things about the Alaska Airlines Credit Card is that it is the perfect choice for anyone who loves to travel. There are no extra charges when you use your card for purchases in different currencies, making it an ideal choice for people who travel frequently for work or leisure.

Plus, it’s great to know that you won’t be hit with any hidden fees when you travel. This means you can enjoy a stress-free vacation without worrying about the additional charges that other credit cards might impose.

To make things even better, the Alaska Airlines Credit Card also offers a range of benefits for travelers. You can earn bonus miles and take advantage of a companion fare offer, which can help you save on airfare costs.

In summary, the Alaska Airlines Credit Card is an ideal choice for anyone who loves traveling and wants a credit card that offers excellent benefits, including no foreign transaction fees. With bonus miles and companion fare offers, this card is perfect for frequent travelers who want to save money and maximize their rewards. So, if you’re planning your next vacation or business trip, consider applying for the Alaska Airlines Credit Card, and start exploring the world without worrying about hidden fees.

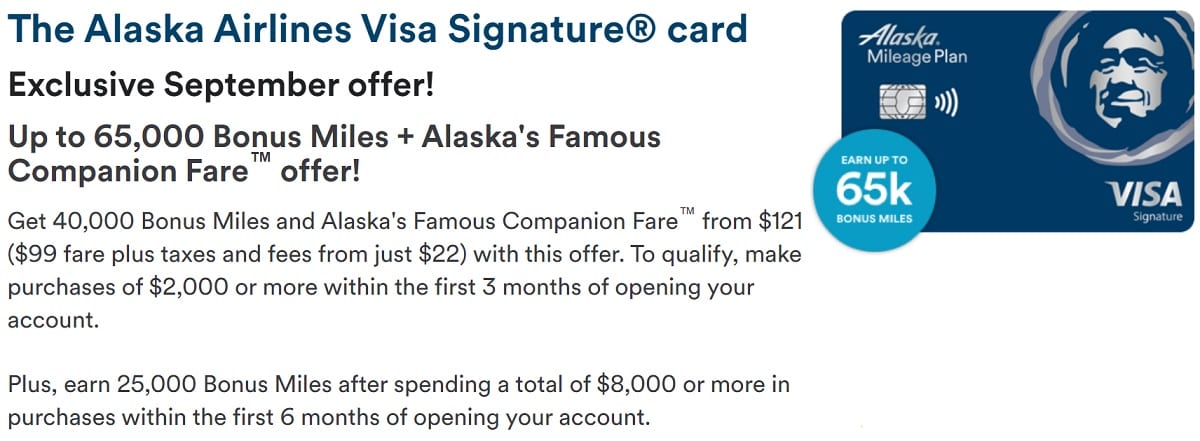

10. Companion Fare and Bonus Miles Offer

As mentioned earlier, the Alaska Airlines Visa Signature credit card offers a fantastic welcome bonus of 50,000 bonus miles, a $100 statement credit, and the Famous Companion Fare™ starting from $122 ($99 fare plus taxes and fees from $23). This offer is perfect for frequent flyers who travel with a partner and are looking to maximize their rewards.

The Companion Fare offer allows you to bring a friend or family member with you on any Alaska Airlines flight and only pay the taxes and fees (starting from $23). This alone can save you hundreds of dollars, making the annual fee of $95 more than worthwhile.

Additionally, the card also allows you to earn 3 miles per dollar spent on Alaska Airlines purchases, with 1 mile per dollar spent elsewhere. This rewards rate is higher than most other airline credit cards in the market and can add up quickly, especially if you use the card for all your travel expenses.

It is important to note that the bonus miles offer is subject to certain terms and conditions. You will need to make eligible purchases of $2,000 or more within the first 90 days of opening your account to qualify. Once you receive your bonus miles, they can be redeemed for award travel, upgrade certificates, or merchandise. However, note that award travel is subject to limited availability, so it’s always best to plan ahead.

To take advantage of this limited-time offer, apply for the Alaska Airlines Visa Signature credit card online. Keep in mind that this offer may not be available forever and is subject to change or withdrawal at any time. If you’re a frequent Alaska Airlines traveler, this credit card is an excellent choice for earning rewards and enjoying a range of excellent benefits.