Traveling is an exciting experience that opens up a whole world of possibilities and adventure. However, unforeseen circumstances can disrupt your plans and leave you stranded in a foreign land. That’s where AAA travel insurance comes in handy, providing coverage and protection to help you tackle any unexpected occurrences during your travels. With AAA California travel insurance, AAA Washington travel insurance, and other options available at allianztravelinsurance.com, you can rest assured that you’ll be safe and secure throughout your journey. From trip cancellation policies to travel interruptions and accidents, AAA travel insurance has got you covered. Keep reading to discover more about what AAA travel insurance has to offer and how it can benefit you on your next vacation.

Table of Contents

1. AAA Washington Travel Insurance: Everything You Need to Know

AAA Washington Travel Insurance is a comprehensive travel insurance policy that offers protection from various unforeseen circumstances while travelling. It covers medical emergencies, trip cancellations, lost or delayed baggage, trip interruptions and more. One of the significant benefits of this travel insurance policy is the extensive network of emergency assistance providers that are available 24/7 to assist travellers in case of emergencies.

The cost of AAA Washington Travel Insurance depends on various factors like the destination, duration of travel, age of the traveller, and type of coverage. The policy provides different types of coverage, including single trip, multi-trip, and annual travel insurance. AAA members can avail of a discount on the policy premium, depending on the level of membership.

The policy covers medical expenses, including emergency medical treatment, medical evacuation, ambulance fees, and repatriation of mortal remains. It also provides coverage for trip cancellations due to unexpected events like sickness, injury, or death of the traveller or their family members. Additionally, it offers coverage for baggage loss, theft, or damage, along with travel delays and trip interruptions.

Despite the comprehensive coverage, there are certain exclusions to the policy, like pre-existing medical conditions, acts of war, and illegal activities. It is essential to read through the policy documents carefully to understand the specific terms and conditions before purchasing the policy.

Overall, AAA Washington Travel Insurance is a reliable option for travellers looking for comprehensive protection while travelling. With its 24/7 emergency assistance network, coverage for medical emergencies, trip cancellations, and lost baggage, it can provide peace of mind and security during your travels.

2. Comprehensive Coverage with AAA California Travel Insurance

With AAA California Travel Insurance, travelers can enjoy comprehensive coverage for their trips. This insurance plan includes a variety of benefits such as trip cancellation or interruption coverage, emergency medical assistance, baggage protection, and more. What sets AAA apart from other travel insurance providers is their focus on customer service. They provide 24/7 customer support and assistance throughout the entire trip.

In terms of pricing, AAA California Travel Insurance is competitively priced in comparison to other insurance providers. Customers have the option to purchase a one-time policy for a single trip or an annual policy for multiple trips. The annual policy is a great option for frequent travelers as it provides coverage for an entire year.

When it comes to customer reviews, AAA California Travel Insurance receives high ratings for their service and comprehensive coverage. Customers appreciate the ease of purchasing the policy online and the quick response time from the customer service team. In addition, customers have noted that filing a claim was a smooth and stress-free process with AAA.

Overall, if you are planning a trip and want to ensure that you are protected during unexpected situations, AAA California Travel Insurance is a great option to consider. With their comprehensive coverage and excellent customer service, you can have peace of mind knowing that you are in good hands.

3. Protect Your Trip with AAA Trip Interruption Insurance

Looking to protect your upcoming trip against unforeseen events? AAA Trip Interruption Insurance may just be the solution you need. This type of travel insurance provides coverage for interruption of your trip due to unexpected circumstances, allowing you to recover some of your pre-paid and non-refundable costs. AAA Trip Interruption Insurance is available to AAA members and can be purchased individually or as part of a comprehensive AAA travel insurance package.

One of the benefits of choosing AAA Trip Interruption Insurance is the ease of use. Simply call the toll-free number provided when you purchase the insurance and a representative will assist you with the claims process. With 24/7 customer support and next business day claims processing, you can rest assured that you will be well taken care of when you need it most.

Coverage under AAA Trip Interruption Insurance includes, but is not limited to, trip cancellation, trip interruption, travel delay, missed connection, and baggage delay. Depending on the coverage you choose, you can be reimbursed for up to 100% of your non-refundable trip costs. In addition, medical evacuation and emergency transportation coverage is also available with some packages.

When considering travel insurance, it is important to research and compare various plans to ensure that you are getting the best coverage for your needs. AAA Trip Interruption Insurance offers a range of options and competitive pricing, making it a great choice for those looking for reliable, comprehensive travel insurance. From solo travelers to families, AAA Trip Interruption Insurance can offer the peace of mind you need to enjoy a worry-free vacation.

4. AllianzTravelInsurance.com: A Convenient Way to Buy AAA Vacation Insurance

AllianzTravelInsurance.com is a convenient online platform to purchase AAA vacation insurance. This online service provides an easy-to-navigate website with comprehensive information about different travel insurance plans that are available for purchase. The website also includes a helpful FAQ section, an efficient claims processing system, and a 24/7 customer support team to address any concerns. One can easily compare different plans and choose the one that best suits their needs and preferences. With AllianzTravelInsurance.com, customers can have peace of mind knowing that they are protected against unforeseen events that could disrupt their travel plans.

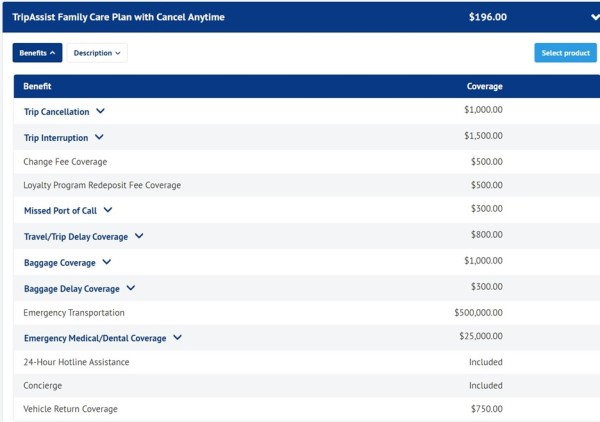

The website offers a wide range of travel insurance plans, including cruises, international trips, domestic trips, and annual plans. Customers can select plans that provide coverage for trip cancellation and interruption, emergency medical expenses, baggage delays, and accidental death and dismemberment. AllianzTravelInsurance.com caters to a variety of travelers from families on vacation to business travelers. The plans are flexible and can be customized to meet individual needs. Moreover, the online platform has a Quick Quote tool, which allows customers to get an estimate of the cost of the plan based on their travel details.

AllianzTravelInsurance.com’s partnership with AAA ensures that customers receive the highest level of customer service and experience. The website is available in English, making it easy for customers to understand and purchase the plan that suits them. The plans are underwritten by Allianz Global Assistance, which is a leading provider of travel insurance and assistance services worldwide. The company’s reputation and commitment to customer satisfaction make it a reliable choice for protecting one’s travel investment.

The process of buying a travel insurance plan through AllianzTravelInsurance.com is straightforward and user-friendly. Customers can easily compare plans, select the coverage they need, and complete the purchase process online. In case of any questions or concerns, the customer support team is available round-the-clock to assist through phone, email, or live chat. With AllianzTravelInsurance.com, customers can travel with confidence knowing that they are protected against unexpected events and can focus on enjoying their trip without worrying about any potential financial losses.

5. Enjoy a Worry-Free Vacation with AAA Travel Insurance

Travel enthusiasts always look forward to having a relaxing and memorable vacation. However, unexpected situations such as trip cancellations, lost luggage, or medical emergencies can quickly turn an exciting trip into a nightmare. Fortunately, AAA travel insurance offers an effective solution to safeguard your travel plans and provide peace of mind. With AAA travel insurance, you can enjoy a worry-free vacation by protecting yourself from potential inconveniences.

One advantage of AAA travel insurance is the wide range of coverage options available to suit different needs and budgets. Whether you’re planning a short domestic trip or an extended international vacation, AAA offers a variety of policies to meet your specific requirements. This includes trip interruption insurance, trip cancellation coverage, and medical emergency protection.

Moreover, AAA travel insurance is also reliable and affordable, with competitive pricing and comprehensive policies. You can choose from several packages, including annual coverage, which offers protection for all your trips throughout the year. The cost of AAA travel insurance varies depending on factors such as the level of protection, duration of the trip, and your age.

Another benefit of AAA travel insurance is the convenience it provides. You can easily purchase your policy online or through a local AAA branch, and the process is quick and straightforward. In case of an emergency, the 24/7 customer support team is always available to assist you.

In conclusion, AAA travel insurance is an excellent investment for any traveler looking to have a stress-free and enjoyable vacation. With its comprehensive coverage, affordable pricing, and convenient services, AAA travel insurance provides the protection you need to relax and enjoy your journey. So why take the risk of traveling without insurance when you can have peace of mind with AAA travel insurance!

6. Get Comprehensive Coverage with AAA Travel Accident Insurance: Reviews

AAA Travel Accident Insurance offers comprehensive coverage to protect travelers against unforeseen circumstances while on their trip. This insurance provides a variety of benefits, including coverage for medical emergencies, evacuations, trip interruptions, and more. One of the significant benefits of this insurance is that it provides coverage for accidents that may occur while travelers are participating in adventurous activities, such as skiing or mountain climbing. This coverage is not typically included in other types of travel insurance policies. With this insurance, travelers can enjoy their trip with peace of mind, knowing that they are protected against unexpected events.

Travelers who are interested in purchasing AAA Travel Accident Insurance can easily do so by visiting the AAA website or contacting a AAA representative. The insurance is available to all AAA members, and the cost varies depending on the length and destination of the trip. It is essential to read the policy carefully before purchasing to understand the coverage and any restrictions. Some restrictions may apply, such as pre-existing medical conditions or hazardous activities not covered under the policy. Overall, the benefits of AAA Travel Accident Insurance overshadow the cost, providing travelers with a valuable safety net while on their trip.

Reviews from AAA Travel Accident Insurance policyholders have been overwhelmingly positive, citing the ease of purchasing the insurance and the peace of mind it provides. Many travelers have mentioned the unexpected events that occurred during their trip, such as a medical emergency or lost luggage, and how thankful they were that they had purchased the insurance. Others have mentioned the helpfulness of the AAA representatives when purchasing the insurance and when filing a claim. The policyholders feel that the cost of the insurance is well worth the benefits it provides and highly recommend it to others.

In conclusion, AAA Travel Accident Insurance is a valuable investment for any traveler. It provides comprehensive coverage that protects against unforeseen events that may occur during the trip, including hazardous activities not typically covered by other insurance policies. The ease of purchasing and the helpfulness of the AAA representatives make it an easy and stress-free process. The positive reviews from policyholders speak to the benefits of this insurance and its ability to provide peace of mind while traveling. Travelers looking for a safety net while on their trip should consider purchasing AAA Travel Accident Insurance.

7. How Much Does AAA Travel Insurance Cost? Find Out Now

AAA provides travel insurance, a valuable product for travelers who need extra coverage to protect them from unforeseen circumstances. However, one may wonder about the cost of this coverage.

AAA Travel Insurance cost varies according to the type of coverage and the duration of travels. The insurance covers trip cancellation, interruption, and delay, as well as medical emergencies, baggage loss, and other unforeseen events.

The cost of AAA Travel Insurance can range from as low as $20 for a short domestic trip to hundreds of dollars for international or longer trips. Premiums can be calculated based on the traveler’s age, destination, and type of coverage, among other factors.

It is worth bearing in mind that AAA offers policies from several insurance providers like Allianz and CSAA that have different fees. Policyholders can also opt for multiple plans such as annual, single-trip, or group coverage to get significant discounts.

One can check the prices of AAA Travel Insurance by visiting their official website or contacting a local AAA agent. Shopping around and comparing the prices of multiple policies can also help to get the most affordable coverage that fits one’s travel needs and budget.

In conclusion, AAA Travel Insurance cost depends on several variables, including destination, duration, type of coverage, and provider. However, it is crucial to assess the potential risk one may face during travels and purchase the right coverage to ensure comprehensive protection, even if it comes at an extra cost.

8. Secure Your Holidays with AAA Annual Travel Insurance

AAA Annual Travel Insurance offers peace of mind to those who frequently travel. With this insurance, vacationers can enjoy their holidays without worrying about flight cancellations, trip interruptions, or medical emergencies. The policy covers trip cancellations, trip interruptions, emergency medical expenses, and baggage loss. The insurance is easy to purchase, and travelers can get a quote through the AAA website. Customers who are already AAA members can get a discount on their insurance.

The cost of the AAA Annual Travel Insurance policy varies based on the coverage selected, the traveler’s age, and the duration and destination of the trip. It is important to note that the policy does not cover pre-existing medical conditions, and it is recommended to read the policy carefully before purchasing. Additionally, the policy offers 24-hour emergency travel assistance, and if necessary, a medical evacuation or repatriation to the United States will be arranged.

Many customers have praised AAA Annual Travel Insurance for its reliable services. The policy is easy to purchase, and the customer service team is knowledgeable and helpful. The claims process is simple, and customers have reported receiving their reimbursements promptly. Moreover, the policy offers a range of coverages that are beneficial to frequent travelers.

In conclusion, AAA Annual Travel Insurance is a reliable policy that benefits frequent travelers. It offers peace of mind and protection against various travel-related emergencies. Customers can choose the coverages that fit their needs, and the policy is easy to purchase and access. With 24-hour emergency travel assistance, travelers feel reassured knowing that they can get help when they need it. Overall, AAA Annual Travel Insurance is a great investment for anyone who wants to secure their holidays and travel with confidence.

9. Stay Safe on the Go with AAA Travel Medical Insurance

Traveling is a fun and exciting experience, but it can also be unpredictable with unexpected medical emergencies. Fortunately, AAA Travel Medical Insurance provides coverage for those unforeseen circumstances. This insurance offers a range of benefits, including emergency medical and dental coverage, emergency medical transportation, and assistance services. With AAA Travel Medical Insurance, individuals can travel with the peace of mind knowing that they are protected from the financial burdens of an unforeseen medical emergency while on their trip.

One of the benefits of AAA Travel Medical Insurance is that it offers coverage for pre-existing medical conditions in certain circumstances. This coverage is subject to the terms and conditions of the policy. It is important to note that pre-existing conditions are not covered under all circumstances, so it is essential to review the policy for specific details. If an individual has a pre-existing condition, it is crucial to disclose this information when purchasing the policy to ensure that they are adequately covered.

Another significant advantage of AAA Travel Medical Insurance is the 24/7 assistance services available to policyholders. In case of an emergency, individuals can contact AAA Travel Medical Insurance for help. They will provide assistance in locating medical care, coordinating medical transportation, and ensuring that individuals receive adequate medical treatment. This assistance gives peace of mind to travelers who may find themselves facing a medical emergency while away from home.

As with any insurance policy, it is essential to review the terms and conditions of the AAA Travel Medical Insurance policy. It is important to understand what is covered and what is not covered to avoid surprises if an emergency arises. Additionally, individuals should make sure to disclose any pre-existing medical conditions they may have to ensure they receive the coverage they need. Ultimately, travel insurance provides peace of mind and assurance that nothing will ruin the fun and excitement of a trip, especially regarding unexpected medical emergencies.

10. AAA Travel Insurance Reviews: Real People, Real Experiences

AAA Travel Insurance is a popular choice among consumers for travel protection. Many people choose AAA due to its longstanding reputation in the travel industry and the perceived benefits of being a member. However, when it comes to the actual experience of using AAA Travel Insurance, opinions are mixed. Some customers have reported positive experiences, citing helpful customer service, ease of use, and fair reimbursement for claims. Others, however, have reported frustration with the claims process, confusing policy language, and difficulty getting in touch with customer service representatives.

One of the major factors affecting customers’ experiences with AAA Travel Insurance seems to be the specific policy purchased. For example, some customers have reported being satisfied with their AAA Trip Interruption coverage, which reimburses travelers for unexpected expenses related to trip interruptions or delays. Others, however, have reported issues with this coverage, including denials of claims for unexpected events that they believed should have been covered. It is important for travelers to carefully review the terms of their policy before purchasing AAA Travel Insurance, and to be aware of any limitations or exclusions that may apply.

Another common complaint among some AAA Travel Insurance customers is the cost of the coverage. Some travelers have reported feeling that the premiums are high compared to other travel insurance options, while others have found the cost to be reasonable given the benefits provided. It is important for travelers to carefully evaluate the cost of AAA Travel Insurance relative to their individual travel plans and budgets, and to consider alternative options if necessary.

Contact Details and Recommendation

AAA Travel Insurance can be reached at 1-800-222-1212 or online at www.allianztravelinsurance.com. They offer a variety of travel insurance plans, so you can find the one that best suits your needs. I recommend getting a travel insurance plan from AAA, as they have a long history of providing reliable and affordable coverage.

Overall, the experiences of customers with AAA Travel Insurance have been mixed. While some travelers have reported positive experiences with the coverage and service provided by AAA, others have experienced frustration with claims denials, confusing policy language, and high premiums. As with any travel insurance purchase, it is important for consumers to carefully evaluate their options and choose a policy that best suits their individual needs and priorities.