Traveling is an exciting experience, filled with adventure, new cultures, and lifelong memories. However, unforeseen circumstances can sometimes occur, putting a damper on your trip. That’s where travel insurance comes in, specifically CSA Cruise Insurance. CSA Travel Protection offers a variety of travel insurance options, including their popular CSA Trip Cancellation Insurance and CSA Seaside Coastal Travel Insurance. With the added benefit of coverage for vacation rentals, such as through VRBO, CSA Insurance has become a go-to choice for many travelers. In this blog post, we will explore the many options and benefits of CSA Cruise Insurance, as well as other offerings from Generali Global Assistance, to ensure that you have a stress-free and protected travel experience.

Table of Contents

1. CSA Cruise Insurance: Comprehensive Coverage for Your Next Adventure

CS Cruise Insurance: Comprehensive Coverage for Your Next Adventure

Planning a cruise can be an exciting experience, but travel insurance can provide peace of mind in case of unexpected events. CSA Cruise Insurance offers comprehensive coverage for various scenarios such as trip cancellation, trip interruption, and medical emergencies. With their cruise-specific policy, travelers can enjoy additional benefits like reimbursement for missed shore excursions and the cost of their cruise cabin if they have to disembark early due to a covered reason.

CSA Travel Protection, now known as Generali Global Assistance, has been providing travel insurance for over 25 years, earning a reputation for reliable coverage and exceptional customer service. They offer a range of insurance products, including vacation rental insurance and trip cancellation insurance. Their website, csatravelprotection.com, provides a user-friendly platform to purchase policies and access travel insurance information.

One of the advantages of CSA Cruise Insurance is the Cancel for Any Reason coverage option, which reimburses up to 75% of trip expenses if the traveler cancels for a non-covered reason. This feature can be particularly useful for those who want flexibility in their travel plans. CSA also offers a 24/7 emergency assistance hotline, which can provide medical referrals, assistance with lost luggage, and other travel-related emergencies.

It’s important to note that CSA Cruise Insurance has certain limitations and exclusions, including pre-existing medical conditions and certain adventure activities. However, travelers can add additional coverage options for these scenarios. Additionally, certain covered reasons for trip cancellation or interruption may require documentation to be reimbursed.

Overall, CSA Cruise Insurance can provide comprehensive coverage and peace of mind for your next cruise adventure. With a range of benefits and options, travelers can customize their coverage to fit their specific needs and enjoy their trip worry-free.

2. CSA Travel Protection: Protect Your Travel Investment Today

Unforeseeable events can suddenly happen during travel, putting your investment at risk. Hence, travel insurance is a must-have to protect your vacation plans. CSA Travel Protection is a company that provides comprehensive travel insurance coverage to shield you from unexpected events that may occur before or during your trip.

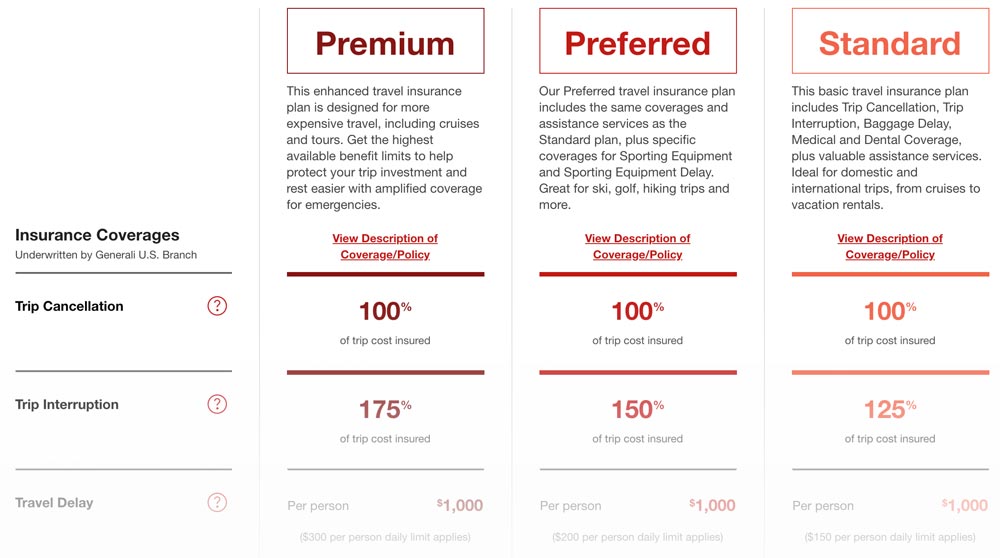

CSA Travel Protection offers trip cancellation, trip interruption, travel delay, baggage and personal effects, emergency medical and dental, accidental death and dismemberment, and rental car damage protection plans. With CSA’s travel insurance, you can receive the compensation for prepaid and non-refundable expenses in case you need to cancel or cut short your trip due to covered reasons.

In addition, CSA Travel Protection provides a list of covered reasons for travel cancellation, including the accidental injury, illness, or death of the travel partner, family members or pet. CSA also covers financial default of the travel suppliers, natural disasters, terrorism, and job loss. Moreover, CSA’s Cancel for Any Reason add-on gives you the flexibility to cancel your trip for any reason like a sudden change of plans or just not feeling like traveling.

Furthermore, CSA Travel Protection offers 24/7 emergency assistance services for your convenience. You will have access to a team of experts who can assist you with medical referrals, travel arrangements, and other emergency assistance no matter where you are in the world.

Overall, CSA Travel Protection is a trusted name when it comes to travel insurance. With its comprehensive coverage, competitive pricing, and excellent customer service, it is a worthwhile investment to protect your travel plans and enjoy a stress-free vacation.

3. Generali Global Assistance: Trusted Travel Insurance for Any Trip

When planning a trip, it’s important to consider all the unexpected events that could occur while on the road. Whether it’s an illness, accident, or cancellation, having travel insurance provides peace of mind and financial protection. One trusted travel insurance provider is Generali Global Assistance, offering coverage for any type of trip. With over 35 years of experience, Generali has a reputation for providing excellent customer service and comprehensive coverage.

Generali Global Assistance offers a variety of travel insurance plans to fit every traveler’s needs. Their plans cover trip cancellation, interruption, medical emergencies, and even come with a 24/7 emergency assistance hotline. With Generali, travelers can choose a plan that suits their specific itinerary, whether it’s a domestic road trip or an international excursion.

One of the standout features of Generali’s travel insurance plans is their coverage for pre-existing conditions. Unlike other providers, Generali offers coverage for pre-existing medical conditions, as long as the policy is purchased within a certain timeframe and certain requirements are met. This can be a game-changer for travelers with chronic conditions who want to make sure they’re covered during their travels.

Generali Global Assistance is also known for their quick and easy claim process. In the unfortunate event that something does happen during a trip, Generali’s claims team strives to process and pay out claims within ten business days. This means travelers can get back to enjoying their trip without worrying about the financial burden of unexpected events.

Overall, Generali Global Assistance is a reliable and trusted provider of travel insurance for any type of trip. With their comprehensive coverage, excellent customer service, and fast claims process, travelers can rest assured they’ll be taken care of in the event of any unforeseen circumstances.

4. CSA Trip Cancellation Insurance: Peace of Mind for Unexpected Events

CSA Travel Protection offers trip cancellation insurance that brings peace of mind to travelers who may have to unexpectedly cancel their trip. This insurance policy covers travelers who are prevented from traveling due to reasons such as injury, illness, severe weather, or a death in the family. With this insurance policy, travelers can cancel their trip and receive reimbursement for non-refundable trip costs. CSA Trip Cancellation Insurance is particularly valuable for travelers who have planned a costly trip, as they can rest easy knowing that their investment is protected.

In addition to trip cancellation coverage, CSA Travel Protection offers other benefits that can be beneficial to travelers. For example, the policy may include reimbursement for trip delay, baggage delay, and emergency medical expenses. Furthermore, CSA Trip Cancellation Insurance may provide coverage for travelers who experience a death in the family and need to return home early. These coverage options allow travelers to focus on enjoying their trip without worrying about unexpected expenses.

One important aspect to consider when purchasing trip cancellation insurance is the type of events that are covered. CSA Travel Protection offers trip cancellation coverage for a wide range of events, including illness, injury, or death of the traveler or a family member, terrorism, natural disasters, and job loss. Travelers should review the specific covered reasons before purchasing the policy to ensure that they are comfortable with the level of coverage.

Overall, CSA Trip Cancellation Insurance provides peace of mind and protection for travelers who may have to unexpectedly cancel their trip. With coverage for non-refundable trip costs, trip delay, baggage delay, and emergency medical expenses, travelers can relax and enjoy their trip without worrying about unexpected expenses. When planning a trip, travelers can benefit from considering purchasing travel insurance to ensure a worry-free journey.

5. Generali Vacation Rental Insurance: Keep Your Vacation Rental Property Safe

Generali Vacation Rental Insurance offers protection to homeowners who rent their property to vacationers. This protection covers accidental damages to the property caused by guests, which includes broken furniture, stained carpets, and damaged appliances. This insurance also covers guests’ accidental injuries that occur on the property. Generali Vacation Rental Insurance provides peace of mind to vacation rental owners by covering a wide range of claims, such as theft and vandalism, which are not commonly covered in standard homeowner’s insurance policies.

In addition to covering damages and injuries, Generali Vacation Rental Insurance also provides liability protection to vacation rental owners. This protection helps cover legal fees and compensation if a guest is injured on the property and sues the owner. Furthermore, this coverage also protects vacation rental owners against claims arising from breaches of rental contracts, such as failing to provide promised amenities or services.

Generali Vacation Rental Insurance also offers emergency assistance services to guests in case of unexpected events, such as flight cancellations, lost luggage, and medical emergencies. This service ensures that guests receive timely and effective support throughout their vacation.

Overall, Generali Vacation Rental Insurance is a comprehensive insurance program that covers a wide range of risks related to vacation rental properties. This insurance provides protection to both vacation rental owners and their guests, giving them peace of mind while enjoying their vacation. With affordable pricing and excellent customer service, Generali Vacation Rental Insurance is a reliable choice for all vacation rental owners who want to protect their investment.

6. VRBO Insurance with CSA: Coverage for Rental Property Damage and More

VRBO Insurance with CSA is a comprehensive travel insurance policy that provides coverage for rental property damage and other mishaps during your vacation. One of the key benefits of this insurance plan is its coverage for damage to a vacation rental property. This policy can help cover the cost of repairs or replacement for accidental damage caused to the property by the policyholder or their guests. It also provides coverage for theft or loss of personal belongings at the rental property, as well as trip interruption and cancellation.

In addition to rental property damage coverage, VRBO Insurance with CSA includes other benefits that can provide peace of mind during your trip. For example, if you experience a medical emergency while on your trip, this policy can help cover the cost of emergency medical and dental expenses, as well as medical evacuation and repatriation. The policy also includes coverage for trip delays and baggage delays, so you can rest assured that you’ll be compensated for unexpected expenses caused by travel mishaps.

Overall, VRBO Insurance with CSA is a well-rounded insurance policy that provides comprehensive coverage for a variety of travel-related mishaps and expenses. It’s a great option for anyone who wants to protect their vacation investment and ensure that they’re covered in the event of an unexpected situation. With its coverage for rental property damage, medical emergencies, trip delays and cancellations, and other mishaps, this policy is a valuable addition to any travel itinerary. Whether you’re traveling domestically or abroad, VRBO Insurance with CSA has you covered.

7. CSA Travel Pro: The Right Choice for Travel Protection

CSA Travel Pro is a trustworthy travel insurance provider that offers comprehensive protection for travelers. By choosing CSA Travel Pro, travelers can ensure that they are protected from unexpected events such as trip cancellations, medical emergencies, and travel delays. With a variety of coverage options available, travelers can customize their policies to suit their specific needs.

CSA Travel Pro offers excellent customer service and support to its clients. Their knowledgeable representatives are always ready to help travelers with any questions or concerns they may have about their policies. Additionally, CSA Travel Pro’s website is user-friendly and easy to navigate, making it easy for travelers to purchase and manage their policies online.

Another advantage of choosing CSA Travel Pro is that they cover a wide range of activities and events, including cruising, adventure sports, and pre-existing medical conditions. Additionally, they offer cancel for any reason coverage, which allows travelers to cancel their trips for any reason and receive a partial refund.

CSA Travel Pro policies offer generous coverage limits, including up to $1,000,000 in emergency medical and dental coverage, as well as up to $300,000 in emergency medical evacuation coverage. They also provide coverage for trip interruptions, trip delays, and lost or stolen baggage.

In conclusion, CSA Travel Pro is an excellent choice for travelers looking for comprehensive travel protection. With their wide range of coverage options, exceptional customer service, and generous coverage limits, CSA Travel Pro provides peace of mind for travelers on any type of trip.

8. CSA Seaside Coastal Travel Insurance: Protection for Beach Lovers

CSA Seaside Coastal Travel Insurance provides an excellent option for those who love to spend time on the beach. This travel insurance is specifically designed to cover any unforeseen circumstances that may occur while on a seaside vacation. Whether it’s a sudden change in weather or an unexpected medical emergency, CSA Seaside Coastal Travel Insurance has got you covered. This insurance offers reimbursement for any trip interruption, cancellation, or delay that results from things like hurricanes, mandatory evacuations, and other covered reasons. Additionally, it provides medical and emergency travel services in the event of an accident or illness that may occur while on the trip.

One of the unique features of this travel insurance is that it also covers rental car damage. It can be especially beneficial for travelers who rent a car while on vacation and want to have protection against any damage that may occur. Additionally, it covers damage to the vacation rental property that may arise during the stay. This feature provides peace of mind to travelers who want to enjoy their vacation without worrying about unexpected expenses.

CSA Seaside Coastal Travel Insurance is available for individuals, couples, and families. It offers different plans that cater to different needs and budgets. Travelers are advised to carefully review the policy details and choose the plan that best aligns with their travel itinerary and budget.

Overall, CSA Seaside Coastal Travel Insurance is an excellent choice for travelers who want protection against any unforeseen circumstances while on a beach vacation. This travel insurance provides coverage for trip interruption, delay, and cancellation, medical emergencies, rental car damage, and vacation rental damage. It offers different plans that cater to different needs and budgets, making it accessible to a wide range of travelers.

9. Guest Protect by CSA: Travel Insurance for Property Owners and Managers

Guest Protect by CSA is a travel insurance product that caters to the needs of property owners and managers. The insurance offers coverage for both the travelers and the rental properties, providing optimal protection against unforeseen circumstances. Travelers can benefit from coverage for trip cancellation, trip interruption, travel delay, baggage delay, medical emergencies, and more. Property owners and managers, on the other hand, can benefit from coverage for damage to the rental property and liability protection.

With Guest Protect by CSA, travelers can enjoy peace of mind knowing that their investment is protected. In case of an unexpected event, such as an illness or injury, the traveler can be reimbursed for their expenses, ensuring a hassle-free travel experience. Additionally, property owners and managers can protect their rental properties from damage caused by renters and other covered events.

One of the standout features of Guest Protect by CSA is the cancel for any reason coverage. This feature allows travelers to cancel their trip for any reason and be reimbursed up to 60% of their non-refundable expenses. This coverage provides added flexibility to travelers who may be hesitant to book their trips due to uncertainties.

Another unique feature of Guest Protect by CSA is the pre-existing medical conditions waiver. This waiver allows travelers with pre-existing medical conditions to receive coverage for their medical emergencies. However, certain conditions apply, and travelers must meet specific requirements to qualify for this coverage.

Overall, Guest Protect by CSA is a comprehensive and reliable travel insurance product that offers optimal protection for both travelers and property owners. The coverage options are flexible, and the cancel for any reason coverage is particularly appealing. With coverage for medical emergencies, trip cancellation, and rental property damage, Guest Protect by CSA is an excellent choice for anyone looking to protect their investment while traveling.

10. CSA Travel Protection Customer Service: Available 24/7 to Assist You

CSA Travel Protection offers customer service that is available 24/7 to assist travelers. They have a team of professionals who can help you with any questions or concerns you may have about their travel insurance products. Their customer service is available in English language, catering to a wider audience. CSA Travel Protection’s team is knowledgeable and can provide assistance with policy details, claims, and coverage questions. Whether you need help with a claim or want to purchase travel insurance, their team is always ready to help. CSA Travel Protection’s customer service is consistently rated highly by their customers, making them a reliable choice for anyone in need of travel insurance.

CSA Travel Protection’s customer service is available round the clock, making it possible for travelers to get assistance when needed. Their team is professional and can handle any issues or problems that may arise during your travels. They can help you with travel-related issues such as lost baggage, trip cancellation, and medical emergencies. CSA Travel Protection’s customer service team is also equipped with the necessary information to help you understand your policy and make informed decisions. They are committed to providing exceptional service and ensuring that their customers are satisfied.

One of the advantages of CSA Travel Protection’s customer service is the ability to assist clients in English language. This makes it easier for travelers to communicate and understand the policies and procedures of their travel insurance products. CSA Travel Protection’s team is fluent in English language and can provide clear and concise instructions over the phone or through email. With a simplified and direct approach, they can help travelers resolve any issues in a timely manner.

CSA Travel Protection’s customer service is attentive and professional, always striving to achieve customer satisfaction. They have excellent communication skills and focus on providing personalized service to each customer. CSA Travel Protection understands the importance of customer relationships and prioritizes customer service to maintain long-term partnerships with their clients. They are dedicated to resolving any issues that may arise throughout the claims process or policy application.

Overall, CSA Travel Protection’s customer service is available 24/7 to assist travelers in English language with any questions or concerns about their travel insurance products. They have a team of professionals who are knowledgeable and can provide excellent customer service. With a focus on customer satisfaction, CSA Travel Protection is a reliable choice for anyone looking for travel insurance. Their attention to detail and personalized service make them stand out in the competitive travel insurance industry.